Pricing Efficiency in Soyabean Marketing: An Evaluation of Costs and Margins in Benue and Enugu States of Nigeria

Dorothy Patience Ani1, *, Sonny Angus Nnaemeka Chidebelu2, Anselm A. Enete2

1Department of Agricultural Economics, University of Agriculture, Makurdi, Nigeria

2Department of Agricultural Economics, University of Nigeria, Nsukka, Nigeria

Email address

(D. P. Ani)

(D. P. Ani)

(S. A. N. Chidebelu)

(A. A. Enete)

Citation

Dorothy Patience Ani, Sonny Angus Nnaemeka Chidebelu, Anselm A. Enete. Pricing Efficiency in Soyabean Marketing: An Evaluation of Costs and Margins in Benue and Enugu States of Nigeria. American Journal of Agricultural Science. Vol. 3, No. 4, 2016, pp. 59-71.

Abstract

Efficient marketing system is a stimulant to the development of a nation’s economy. The study examined the pricing efficiency, margins and costs in soyabean marketing in Benue and Enugu States, Nigeria. Primary data were collected using structured questionnaire administered to 207 soyabean marketers who were randomly selected from four purposively selected markets in each State. Data collected were analyzed using descriptive statistics, marketing margin model, ANOVA and t-test. The result showed that mean marketing margin were 19.98% and 20.89% with an overall margin of 20.4%. Average net margin were N405.79 and N786.26 for Benue and Enugu markets respectively which represented 6.24% and 9.84% of the cost price of a 100kg bag of soyabean. Furthermore, it costs N823.25 and N932.06 on the average to market a 100 kg bag of soyabean in Benue and Enugu States, respectively. While there was no significant difference (F= 0.922; P=0.490, F=1.116; P=0.354 and F=1.45; P=0.187) in the marketing margins, costs and net margins across the eight markets sampled, there were significant differences (F=6.307; P≤ 0.01, F=3.557; P ≤0.05 respectively) in the marketing costs and net margins of the different participants. The result of the Posthoc of the ANOVA showed that marketing costs incurred by wholesalers were significantly different from that of retailers and rural assemblers. The items that constituted the major costs in soyabean marketing were transportation (32.82%), storage (19.99%), loading and offloading (8.72%), Bagging and rebagging (8.468%) and commission fee (8.30%). The mean marketing efficiency for Benue and Enugu marketers were 90% and 138% which were significantly different (t=-3.070; P≤ 0.01). The moderately high marketing margin obtained implied inefficiency in soyabean marketing. Their marketing costs were dominated by transportation and handling costs. Enugu marketers were significantly more efficient than their Benue counterparts. More soyabean processing companies should be established. Increased household utilization should be advocated. Infrastructural facilities (such as good roads, market stalls) and market information should be provided to enhance the efficiency of soyabean marketing in the study area.

Keywords

Efficiency, Margins, Soyabean, Costs, Marketing

1. Introduction

Agricultural marketing assumes greater importance in the Nigeria economy because excess production from the farm must be disposed off in order to earn some income with which farmers can purchase goods and services not produced by them (Adekanye, 1988). Soyabean (Glycine max), a herbaceous annual food legume, is an important food, feed, oil and cash crop in the world. It has been the dominant oilseed produced since the 1960s and is used as human food, livestock feed, and for various industrial purposes (Myaka, Kirenga & Malema, 2005). Described as a ‘miracle bean’ or ‘golden bean’ because of its cheap protein-rich grain, it is obvious that soyabean is a commodity of interest and warrants special attention for several reasons. First, it plays an important role in Nigeria as food supplement in many homes and a prominent role in livestock industry especially in the manufacture of poultry feed; and secondly, the structure and conduct of soyabean marketing can affect the economy of the people and nation’s economy in significant ways (Onu & Iliyasu, 2008). Its industrial uses range from the manufacture of edible oil, infant food supplements, pharmaceutical, paints, cosmetics, soap-making to animal feeds (Singh, Rachie & Dashiell, 1987).

According to Adekunle, Ogunlade and Ladele, (2003), world production statistics acclaimed Nigeria the second largest producer of soyabean in Africa after Zimbabwe and also, surprisingly, considered Nigeria a protein deficient country (Okuneye, 2002). Average consumption of animal protein in Africa is less than one quarter of what is consumed in Americas, Europe and Oceania, and represented about 17 percent of the recommended consumption level for all proteins (FAO, 2011). Evidence has shown that soyabeans carry twice the protein of meat or poultry and contain all eight essential amino acids needed for childhood development and is yet affordable. In other words, increased production and efficient distribution and marketing of soyabeans can be a panacea for malnutrition and Kwashiokor prevalent among children in rural areas. There exists inadequate empirical information on soyabeans marketing that will enhance understanding and hence improvement of the operation of soyabeans markets in Nigeria. Moreso, the knowledge of marketing margin and pricing efficiency determine to a large extent marketing efficiency and integration (Negassa, 1994). In order to facilitate agricultural development process, analysis of pricing efficiency of foodstuff (soyabeans inclusive) is considered very pertinent and, it is expected that favourable pricing efficiency will stimulate more of the products concerned to be produced.

Marketing margin for a particular commodity has been defined as the difference between what the consumer pays for the final product and the amount the producer receives (Olukosi & Isitor, 1990; Amobi, 1996; Arene, 2003). At each intermediary level, it is the difference between price received on resale and the purchase price (Mejeha, Nwosu & Efenkwe, 2001; Gabre-Madhin, 2001). In other words, marketing margin reflects the costs and profit of middlemen (Olukosi & Isitor, 1990; Minot & Goletti, 2001). These costs are incurred mainly in adding utilities of time, form, place and possession. Costs mentioned by Barallat, McLaughlin & Lee (1987) included payments for all initial assemblage, storage, processing, transporting, warehousing and retailing charges. The profit range accruable to the market participants gives an indication of market performance (Achoga & Nwagbo, 2004).

Marketing margin can also be extended to mean the differences between prices at two market levels. Marketing margins are being examined on the basis of data obtained on prices at different stages of the marketing chain. Marketing margins are calculated through computing the absolute margin or price spread, which is essentially the same as the difference between the price paid and received by each specific marketing agency. An economic analysis of marketing margin of Benniseed in Nasarawa State, Nigeria, carried out by Achike and Anzaku (2010) revealed that the mean marketing margin was 18.2%, while marketing costs were 12.8%; net profit 8.3%; whereas farmer’s share was 78.9% of the retail price. In other words, these values indicated efficient and competitive trends under the prevailing circumstances. Also, their ANOVA results showed that marketing margins at the three main market centers sampled were significantly different. High marketing margins are sometimes regarded as evidence of inefficiency and the middlemen are often blamed for earning excessive profits. This is not always true as an increase in absolute margin is not clearly an indicator of efficiency or inefficiency of the marketing system. It may mean that returns to factor inputs have increased rather than that the inputs are being wastefully utilized. Then again, the increase in margins may be due to an improvement in the services performed or the utilities created for the consumers. In the estimation and utilization of marketing margins, possible problems that can arise are because of non-homogeneity of commodity with resulting variation in quality for a particular commodity and non-standardization of quantity measure.

Moreover, Olukosi et al., (2005) further viewed marketing margin from the following angles:

1. marketing margin is the difference between the price paid by consumers and that received by the producers; or

2. marketing margin is the outcome of the demand for and supply of such services.

Furthermore, the time-lag between the different processes involved in marketing between wholesale and retail, during which effective price changes could have taken place makes it difficult to estimate correctly the value (form, time, place and possession utilities) added to commodities during marketing (Adekanye, 1982). Nevertheless, marketing margin has remained an important tool in analyzing the performance of marketing systems. Marketing costs and profit margins which make up marketing margins can be both indicators of efficiency or inefficiency of marketing systems. The benefits that accrue to the individual participants may be incentives or disincentives to continue in the business. Proper computation, understanding and interpretation of marketing margin value in relation to prevailing circumstances can reveal a lot about performance in the marketing channels. The portion of the consumer’s food expenditure that goes to food marketing is referred to as the marketing margin. It is in a sense the price of all utility adding activities and functions performed by the food marketing system.

Also marketing margin analysis is a useful tool to examine the nature of the marketing system, particularly, when marketing margins are deconstructed into various functions performed by the market traders. Therefore, detailed information of the marketing system is needed before the marketing integration, efficiency and competitiveness of the system can be inferred from the price data. In market literature, researchers have questioned the reason for low margin accrued to marketers and they identified market imperfection and not competitive practices as factors contributing to low returns from marketing (Okereke, 1988). Okunmadewa (1990) asserted that an efficient marketing system is a stimulant to the development of nation’s economy. They noted that food markets are operating in a weak institutional environment where institutions are deficient and the small scale nature of most of the transactions further constrain the effectiveness of existing formal institutions. Onu (2000) discovered marketing imperfections with respect to cotton marketing in Nigeria. He found a high marketing margin and confirmed that the performance of the markets exhibits pricing inefficient and high degree of independence.

Marketing costs according to Tomek and Robinson (1981) are the actual expenses incurred in the performance of the marketing functions as a commodity moves from the farm to the ultimate consumers. It includes the cost of transportation and handling, marketing charges, cost of assembling, processing, distribution, cost of packaging, sales promotion and advertisement cost and other costs such as taxes, levies and exercise duties. According to Olukosi et al. (2005), marketing costs are often erroneously assumed to be synonymous with marketing margin but the true relationship is that marketing margin includes marketing costs plus the normal profit (or loss) earned by the market intermediaries as the commodity passes through the marketing system. Marketing costs consist of fixed and variable costs (Tomek and Robinson, 1981). They noted the important components of the marketing costs are: (i) Transfer costs (ii) Processing costs (iii) Storage costs and (iv) Sales promotion and advertisement costs. It has been widely recognized that the farm gate price is only a fraction of the purchase price in any typical rural agricultural economy. Jayne (1994) stated that the width of the wedge between these prices is a function of transportation, storage and processing technology, infrastructure, policy-related factors, and institutions that coordinate exchange across space, time and form. The total marketing costs involved in sorghum distribution in Sudan accounted for 10% and 14% of the consumer and producer’s prices, respectively (SIFSIA, 2011). According to the report, sorghum loading and offloading costs exceed the transportation and constitute 2.4% and 3.5% of the consumer and producer’s prices, respectively. A study by Onu and Iliyasu (2008) showed transportation cost, produce tax and re-bagging costs represented 40.4%, 29.6% and 27.9% of the total marketing cost, respectively. Similarly, Achike and Anzaku (2010) found that the costs of wholesaling consisted mainly of charges for the storage, transportation, handling of the product, levies imposed by government agents or representatives at designated roadblocks and commissions paid to buying agents. Conversely, they found that payment for movement of the commodity within, to and from the markets, handling, repackaging and merchandising constituted the main costs of retailing. Similarly, Fafchamps and Madhin-Gabre (2001) showed that transportation costs forms a large share of total marketing costs. Thus, the objectives of the study were to:

i. assess the marketing margins and costs of market participants;

ii. describe the major components of marketing costs in the study area;

iii. determined the pricing efficiency in the marketing of soyabeans;

The following hypotheses were tested:

i. marketing margin and costs of market participants in the two States are the same; and

ii. marketing of soyabean in Benue is more efficient than in Enugu State.

2. Materials and Methods

2.1. The Study Area

The study area is Benue and Enugu States of Nigeria. These States belong to the North-central and South Eastern zones of the country, respectively. Benue State was created on 3rd February, 1976. The State is located in the middle belt of Nigeria, approximately between latitudes 6030ʹN and 8010ʹN of the equator and longitudes 6035ʹE and 8010ʹE of the Greenwich meridian, at an elevation of 97 meters, above sea level in the southern guinea savannah agroecological zone. It has a landmass of 6.595 million hectares [Benue State Agricultural and Rural Development Authority, (BNARDA), 1998]. Benue State has a total population of 4,219,244 (NPC, 2006), and is made up of 413,159 farm families (BNARDA, 1998). The State is bounded by Nasarawa State in the North, Taraba State in the East, Cross-River State in the South, Enugu State in the Southwest, Ebonyi State in the South Central, Kogi State at the West and at the Southeast by Cameroun Republic. Benue State derives its name from the River Benue; the second largest river in Nigeria.

The State is made up of 23 Local Government Areas and is divided into three agricultural zones A, B and C. The dominant ethnic groups are Tiv and Idoma. Other smaller ethnic groups are Igede, Etulo and Hausa. According to BNARDA (1998), the predominant occupation of the people of Benue is farming with over 80 percent engaged in farming and highly noted for substantial cultivation of arable crops like yam, cassava, rice, soyabeans, maize and other staples. Marketing of all food stuffs especially farm produce are extensively carried out in North-Bank market, Modern market, Wurukum, Railway, Lessel, Gboko, Wannune, Daudu, Gbajimgba, Naka, Otukpo, Daudu and Aliade markets in the State.

Enugu State was created on August 27, 1991, with the city of Enugu as its capital. Enugu State is located between latitudes 5056ʹN and 706ʹN and longitudes 6053ʹE and 7055ʹE of Greenwich Meridan [Enugu State Agricultural Development Project (ENADEP), 2009]. The State occupies a landmass of approximately 8,022.95km2 and a population of 3,257,298 (NPC, 2006). It shares boundaries with Anambra State on the West, Abia State on the South, Kogi State on the North and Benue and Ebonyi States on the East.

The State has 17 Local Government Areas and according to ENADEP (2012), the State is further divided into six (6) agricultural zones namely: (i) Nsukka zone (ii) Enugu Ezike zone (iii) Enugu zone (iv) Agbani zone (v) Awgu zone and (vi) Udi zone. Economically, the State is predominantly rural and agrarian, with a substantial proportion of its working population engaged in farming, although trading (18.8%) and services (12.9%) are also important (William, 2008). In the urban areas, trading is the dominant occupation, followed by services. The major markets in Enugu State are Ogbete main market, New Market/Relief, Ogige Nsukka market, Orie Orba, Obollo-Afor, Orie Awgu, Eke Agbani, Nkwo Ogbete, Orie Opanda and Adani market.

2.2. Sampling Procedure

A two-stage sampling technique was adopted in selecting the respondents. First, from the two selected States, four markets each were purposively selected based on the relative predominant availability of soyabean in the area. The markets surveyed in Benue include Wannune, Lessel, Gbajimgba and NorthBank whereas Orie Orba, Ogbete, Eke Agbani and Orie Awgu were sampled in Enugu State. Subsequently, from each of the selected soyabean markets, a minimum of 20 middlemen (wholesalers, retailers and rural assemblers) were selected using simple random sampling technique; although rural assemblers were not found in Enugu markets. Thus, a total of 97 and 110 respondents were sampled in Enugu and Benue markets, respectively which summed up to 207.

2.3. Data Collection

The study made use of primary data. Primary data were obtained mainly through the use of structured questionaire administered to soyabeans marketers.

2.4. Data Analysis

Data were analyzed using both descriptive and inferential statistics. Objective I was realized using marketing margin model; objective II were realised using descriptive statistics while Objective III was achieved with pricing efficiency model. T-statistics was used to achieve hypothesis ii whereas t-statistics and ANOVA were used for hypothesis i.

2.5. Model Specification

2.5.1. Marketing Margin Model

The marketing margin model stated mathematically below will be employed to estimate the marketing margins of wholesalers and retailers.

GMM (N) = SP – PP

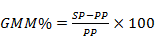

This is expressed as percentage of retail price as:

(1)

(1)

where:

GMM = Gross Marketing Margin

SP = Selling Price (N)

PP = Purchase Price (N)

RP = Retail Price(N)

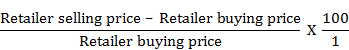

Alternatively, the marketing margin for market participants can be calculated thus:

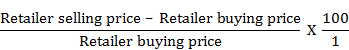

For wholesaler:

For retailer:

2.5.2. Net Margin Analysis

The net margin of a specific agency is the net earnings, which it earns after paying all marketing costs. The procedure for computing net marketing margin is as stated below:

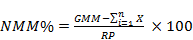

(2)

(2)

where:

NMM = Net Marketing Margin

GMM = Gross Marketing Margin

n = Costs of marketing (

n = Costs of marketing (N)

RP = retail price (N)

2.5.3. Pricing Efficiency

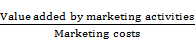

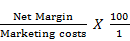

Marketing efficiency was calculated using the formula given by Khols and Uhl, (1967) which was used by Olukosi and Isitor (1990) and later used by Babatunde and Oyatoye (2000) in estimating the marketing efficiency of maize in Kwara State. The formula specified that:

Marketing efficiency =  X

X (3)

(3)

In other words, Marketing efficiency =  (4)

(4)

2.5.4. Analysis of Variance (ANOVA)

Analysis of variance is used to infer existence of difference across group means when the number of groups are greater than two. The analysis of variance procedure is based on F-test such that:

F=

F* =

Where

MSTR=

I= number of treatments

And MSE =

Where nt= total number of cases

ANOVA was used to assess the difference in marketing margin, marketing cost and net margin among different middlemen in the two States.

2.5.5. T-test of Mean Difference

The t-test was used to compare two means. The test was applied in this study to assess the differences in the marketing efficiency of the two States.

3. Results and Discussion

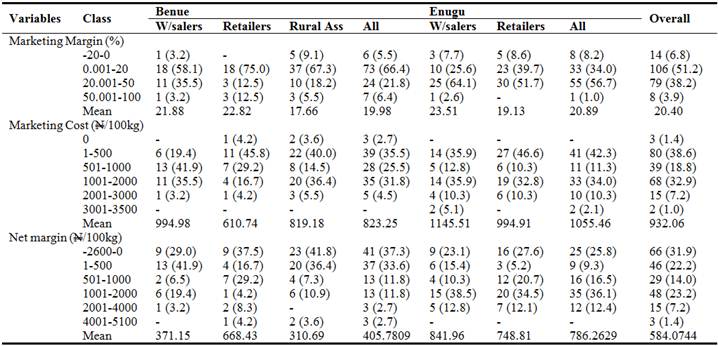

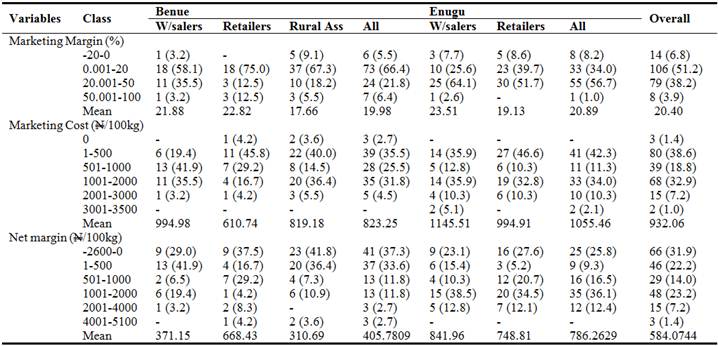

Table 1. Marketing margin, Costs and Net margin of marketing participants in the two States.

Figures in parentheses are percentages, Source: Computed from field data, 2014.

3.1. Description of Marketing Margin of Soyabeans Traders

The result of the marketing margin of soyabean traders in the study area is presented in Table 1. Marketing margin refers to the difference between the producer price of soyabean and consumer price. In this context, marketing margin refers to the percentage difference between the selling and purchase price. Wholesalers and retailers marketing margins were expressed as percentage of the wholesale and retail prices, respectively. The study found a lot of variations in prices received by the rural assemblers, wholesalers and retailers. For instance, 6.8% of the marketers had negative marketing margins. In other words, very few proportion of the respondents operated at a loss. However, the modal class of marketing margin found for Benue marketers was between one and 20 percent while for Enugu marketers, marketing margin was skewed towards 20 and 50 percent. The mean of the marketing margin for both States did not differ much being 19.98% and 20.89%, respectively for Benue and Enugu States, having an overall mean of 20.40%. This implied that 20 percent profit would be realized from every purchase made. Specifically, from the result, wholesalers in Benue and Enugu States had marketing margins of 21.88% and 23.51%, respectively. This result agreed with the findings of Enete & Agbugba (2008) who obtained 22.3% marketing margin for wholesalers that engaged in charcoal marketing in Abia State.

Furthermore, for retailers, marketing margins of 22.8 % and 19.13% was obtained for Benue and Enugu States, respectively. This implied that for every N1 spent by a consumer for 1kg of soyabean, about 45 and 43 Kobo, went to cover the middlemen’s marketing costs in Benue and Enugu States. Also, as a rule of thumb, Riley (1972) had reported that efficient markets in developing countries must have a retail margin of less than 10 percent of the consumers’price for non-perishable goods like soyabean. Thus, marketing margin of 22.8 and 19.13% found in this study therefore suggested inefficiency in soyabean marketing. These margins, though moderately high was enough to keep marketers in the business. Although there were low participation of food grain marketers in soyabean enterprise; those involved still made profit even though it had low turn-over and low patronage by household consumers unlike other food stuffs. Marketing margins of 11.9 and 24.4% were obtained for pineapple marketing in rural and urban areas in Lagos State by Oladapo et al., (2007); which depicts market inefficiency. According to Enete (2003), high marketing margin often reflect socio-economic environment of the actors. Onu (2000) found high marketing margin in cotton marketing in Nigeria which confirmed that the performance of the markets exhibited pricing inefficiency and imperfections, and high degree of independence. Also, Ebe (2007) observed a high marketing margin of 46% for fuel wood in Enugu State, Nigeria. This contradicted what is expected from undifferentiated primary products in competitive markets (Gabre-Madhin, 2002). Again, the marketing margins of retailers in Enugu State were generally lower than those of Enugu State wholesalers. This was probably because retailers typically bought and sold soyabean in the same market, thereby incurring less risks and costs. This is in agreement with the findings of Achike & Anzaku (2010) who found similar result for Benniseed marketers in Nasarawa State.

3.2. Result of Net Margin

Net margins of soyabean market participants are presented in Table 1. Net margin of market participants meant the net earnings or profit gained after paying all marketing costs. The results showed that among the market participants in the study area, wholesalers in Enugu State got the highest marketing margin of 23.51% although for all market participants, the net margin was moderately high (20.4%). This could be as a result of their return to high capital investment in the business. The result also showed that only very few marketers (3.9%) had net margin within the range of 50 and 100 percent. Average net margin for Benue State soyabean marketers was N405.79, while that of their Enugu counterpart was N786.263 which represented 6.24% and 9.838% of the cost prices of 100kg bag of soyabean in Benue and Enugu markets, respectively, (assuming July cost price of N6,500 and N8,000 in Benue and Enugu States, respectively). Gabre-Madhin (2001) attributed traders’ net margin of less than 5% in grains trade to the existence of competitive pressure. Thus, the value obtained here being more than 5% further indicated uncompetitive nature of soyabean market. Akanni (2011) found net margin for food grain marketers in Osun and Oyo States as N900/100kg and N433/100kg bag of maize, respectively which is similar to the result of this study.

The result of net margin for 100kg bag further showed that moderately high proportion of respondents (31.9%) operated at a negative net margin. This could be as a result of numerous costs involved in the marketing process which included administrative charges, assembling, handling and transfer costs. Conversely, wholesalers in Enugu State made the highest net margin per 100 kg bag of soyabean while the least earner group was rural assemblers (mean of N310.69). This could be as a result of their low capital investment and low value addition in the enterprise.

3.3. Result of Marketing Costs

Furthermore, analysis of marketing costs showed that few marketers in Benue State (2.7%) did not incur any cost in soyabean marketing (Table 1). This could be explained by the fact that they simply bought in small quantities directly from the farmer and immediately sold same to either fellow rural assemblers or wholesalers with a very little margin without much value addition. However, some marketers, especially wholesalers in Enugu State (5.1%) spent about N3,000 to N3,500 per 100kg bag of soyabean. Similarly, wholesalers in Enugu State had the highest mean marketing cost of N1,145.51. This corroborated the earlier finding that they incurred the highest cost and as well had the highest marketing margin. The result showed that while it costs marketers in Benue State N823.25 on the average to sell a 100kg bag of soyabean, it takes N932.06 for marketers in Enugu State to sell one 100kg of soyabeans. The group that incurred the least cost in soyabeans marketing was Benue State retailers who spent N610.74 on average for a 100kg bag of soyabean. This could be as a result of their close proximity to the source of the produce. This disagreed with the findings of World Bank (2009) that short distance marketing had much higher cost on the basis of kilometer per tonne.

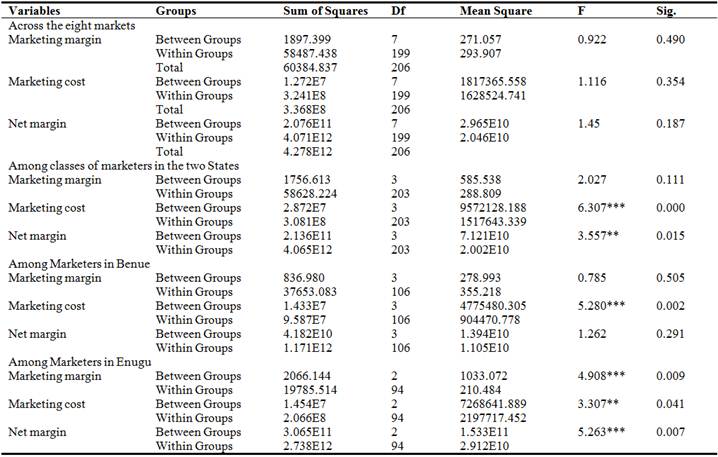

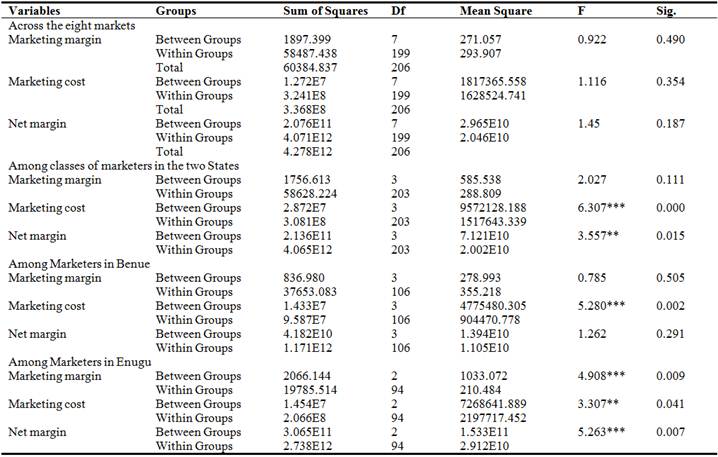

Table 2. Result of ANOVA showing the difference between marketing margin, costs, and net margin among the marketing participants in the two States.

***,** - Significant at 1% and 5%, respectively. Source: Computed from field data, 2014.

3.4. Differences in Marketing Margins, Marketing Costs and Net Margins Among the Marketing Participants

This section sort to find out whether there were significant differences in the marketing margins, marketing costs and net margins of marketers. The results of ANOVA showing the differences in marketing margins, marketing costs and net marketing margins are presented in Table 2. The result showed that across the eight markets sampled in the study area, there was no significant difference (F= 0.922; P=0.490, F=1.116; P=0.354 and F=1.45; P=0.187) in the marketing margins, costs and net margins. The reason could be as a result of the nature of soyabeans marketing; being an industrial commodity, the major key players (processors) coordinate and regulate prices so that irrespective of the markets, the same price prevails. This could account for the similarities in the marketers’ margins and costs observed. Also, among all the soyabeans marketers in both Benue and Enugu States, there was no significant difference (F=0.146; P=0.702) in their marketing margins. This could be as a result of almost equal margins observed in both States. This meant that the marketing margin observed in Table 1 did not differ significantly from one another. In other words, the difference in the marketing margin observed among the soyabeans marketers was not significantly different from zero. Hence, the null hypothesis which stated that the marketing margins at different markets in the two States were not significantly different was accepted. This result contradicted the result of Achike & Anzaku (2010) who found significant difference in marketing margins among Benniseed traders in Nasarawa State. Soyabeans having high industrial demand could account for the same margin across States as processing companies coordinate and regulate prices thus ensuring almost uniform profit among marketers.

However, analysis of marketing costs and net margins showed that there were significant differences (F=6.307; P≤ 0.01, F=3.557; P ≤0.05 respectively) in the marketing costs and net margins of the different participants in the study area. This meant that the costs incurred in soyabeans marketing varied significantly from one marketer group to another. This finding corroborated the earlier result that wholesalers in Enugu State spent the highest amount in soyabeans marketing than other groups due probably to long distances leading to high transport costs, costs of booking at markets and payment of tax and produce levies at road blocks. All these variables contributed to high cost incurred by wholesalers in the business. Similarly, the result showed that the net margin from soyabeans marketing varied significantly (F=3.56; P≤0.01) from one marketer group to another. As observed in Table 1, net margin of wholesalers was found to be the highest while that of rural assemblers was the least. This could be as a result of disparity in their capital base and value addition to the enterprise. While wholesalers incurred more cost, they likewise earned more profit. Their net earnings differed significantly from others whose committments were less. Following the result of the ANOVA, the null hypothesis which stated that there was no significant difference in the marketing costs and net margins of soyabeans marketers was rejected. Hence, the alternative was accepted.

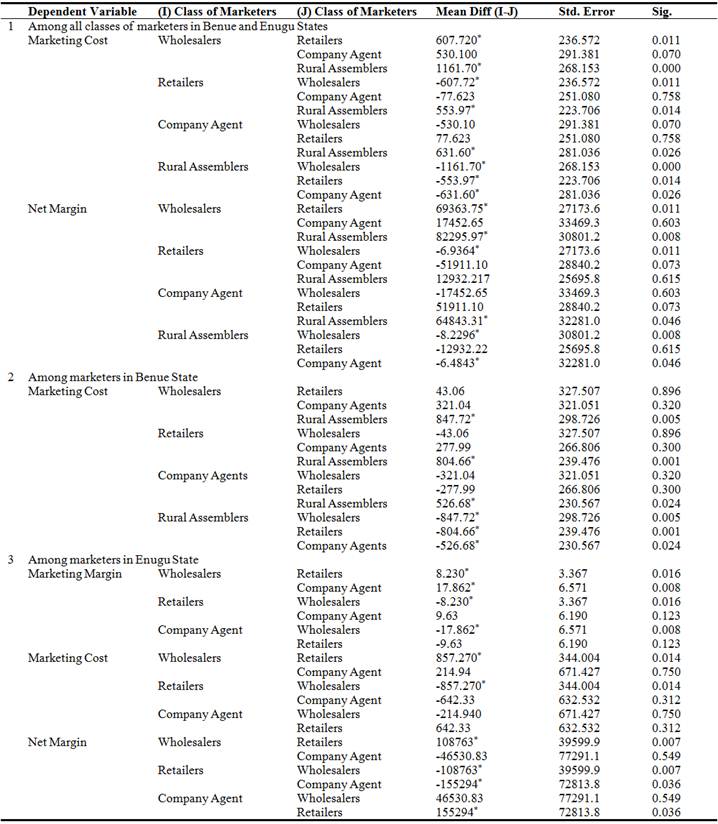

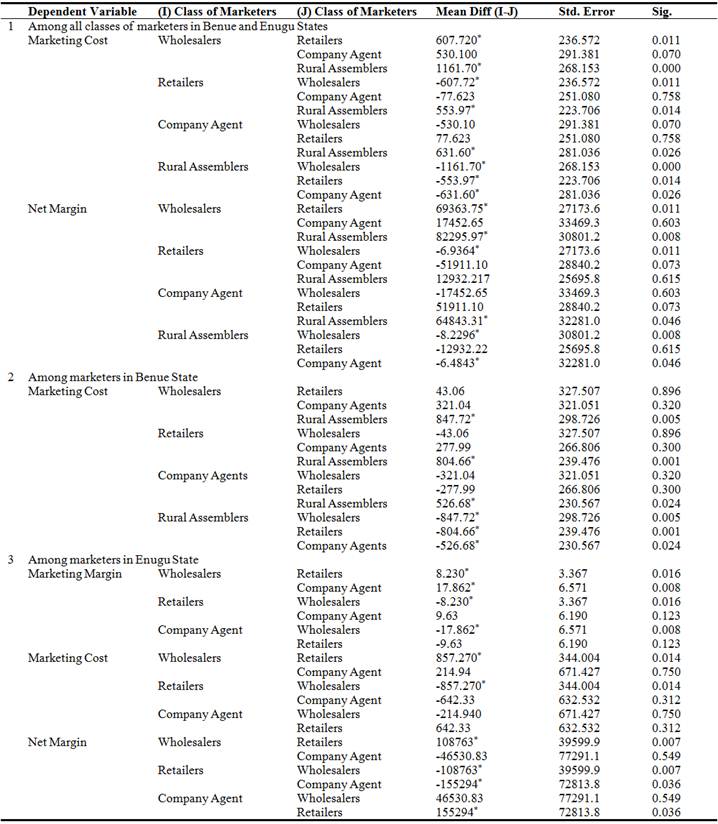

Table 3. Result of Post-hoc of ANOVA showing the mean difference in marketing costs, and net margin among marketers in the two States.

*. The mean difference is significant at 0.05 level.

Further analysis of the difference in marketing costs through posthoc of the ANOVA (Table 3) showed that specifically, marketing costs incurred by wholesalers was significantly different from that of retailers and rural assemblers. This could be as a result of the high costs incurred by wholesalers arising from the high volume of trade they handle. Similarly, the result of the posthoc of the ANOVA showed that the net margin realised from soyabeans business by wholesalers was significantly different from that of retailers and rural assemblers. The low volume of trade handled by retailers and rural assemblers could account for their low return.

Furthermore, among soyabeans marketers in Benue State, there was no significant difference in the marketing margins (F=0.785; P=0.505) and net margins (F=1.262; P=0.29). This meant that marketing margin and net margin of marketers in Benue State did not differ significantly from one another. The near absence of soyabeans processing firms and poultry feed mills in the State made majority of the marketers to operate at almost the same level as commission agents and rural assemblers (BRENDA) with almost the same level of margin. However, there was significant difference (F=5.28; P≤0.01) in their marketing cost. The different cost constituents and different taxes at different markets makes their marketing costs to differ. Their expenditure in the business was found to be different at different markets for instance, in some markets, it was compulsory for traders to join the marketing unions, pay levies and dues, while in some markets, membership of market unions was optional. Moreover, they pay varying taxes and transportation costs at different markets. Moreover, the result of the posthoc of the ANOVA (Table 3) showed that rural assemblers incurred marketing costs which was significantly lower than that of wholesalers, retailers and company agents. This could be as a result of their little committment in the business cycle since they usually buy and sell soyabeans in the same market without incurring transportation cost, produce, storage, loading and offloading.

On the other hand, in Enugu State, among the soyabeans marketers, there were significant differences (F=4.908; 3.307 and 5.263; P≤0.05, respectively) in the marketing margins, marketing costs and net margins. This could be due to their different buying capacities. While majority of them were company agents as a result of the many soyabeans processing firms in the State, others were petty traders who sell soyabeans just to have complete foodstuff. Owing to low patronage arising from low household utilization, the turnover from the business was usually very low except for wholesalers. This could account for the difference in their margin and costs. Specifically, the result of the posthoc of the ANOVA (Table 3) showed that among marketers in Enugu State, the wholesalers made the highest marketing margin. Their marketing margin was significantly higher than that of retailers and company agents. Since wholesalers hold the bulk of soyabeans in the face of high demand arising from many processing firms and feed mills in the State, they are bound to make the highest margin. However, their marketing costs were significantly higher than that of retailers but not different from that of the company agents. This probably could arise from the fact that wholesalers bear almost all the costs involved in the marketing of soyabeans. Similarly, their net margin was significantly higher than that of the retailers but not different from the company agents.

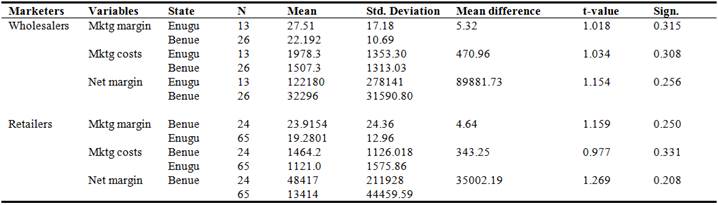

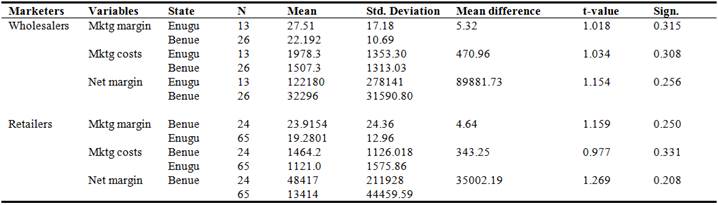

Table 4. Result of the t-test showing the difference in marketing margin, costs and net margins among wholesalers and retailers in the two States.

Source: Computed from field data, 2014.

Among the wholesalers in the two States, there was no significant differences (t=1.018, 1.034 and 1.154; P=0.315; 0.308 and 0.256, respectively) in the marketing margins, marketing costs and net margins (Table 4). This meant that the variations observed in the marketing margins, marketing costs and net margins were not significantly different from zero. Although the earlier result showed that wholesalers in Enugu State incurred more costs in marketing than other groups, the difference among the wholesalers in the two States was not significant at 5% level. This could be due to the similarities in their marketing roles and buying capacities which gave rise to same margins and costs.

Similarly, between retailers in the two States (Table 4), there was no significant difference in their marketing margins (t=1.159; P =0.250), marketing costs (t=0.977; P=0.331) and net margins (t=1.269; P=0.208). This meant that the difference in marketing margins, costs and net margins of retailers in the two States were not significantly different from zero. Their close similarities in market functions and sales volume could account for the similarity in their margins and costs.

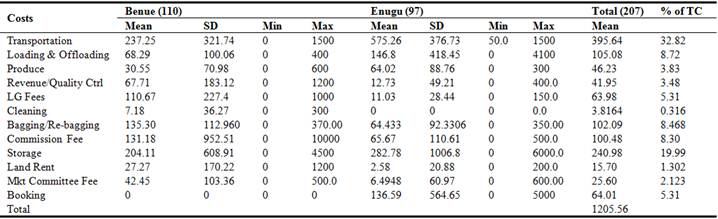

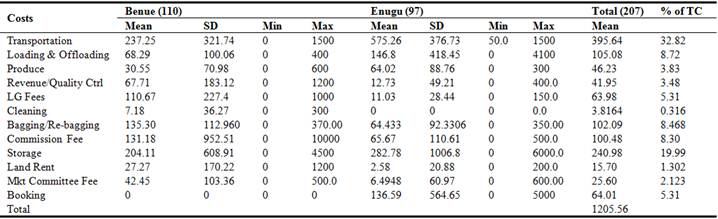

Table 5. Description of marketing costs in Benue and Enugu States.

Source: Computed from field data, 2014.

3.5. Components of Marketing Costs

In a competitive and efficient market, marketing costs determine the size of returns to farmers and middlemen. Besides, computations of marketing margins are largely dependent on marketing costs. Table 5 summarized the components of marketing costs. The result showed an array of items that constituted costs which ranged from transportation cost to vigilante fee. Among the Benue soyabean marketers, the items that constituted the major costs ranged from transportation (N237.25), storage (N204.11), Local Government fee (N110.67), loading and offloading (N68.29) to bagging (N65.45). However, they did not spend money on booking, market sanitation and vigilante fee. The minimum value of zero observed for variable costs among Benue markets indicated that few marketers did not spend money on some of these cost items.

Similarly, among Enugu soyabean marketers, the major components of costs were transportation (N575.26), storage (N282.78), loading and offloading (N146.8). Similar result was found by Oladapo et al., (2007) who found out that transport represented the largest component (61.9 % and 57% of the total cost) in pineapple marketing in Edo and Oyo States. However, no amount was spent on cleaning of soyabean as the wholesalers always bought already cleaned seeds. The minimum amount of zero found in almost all the cost items depicted few marketers especially retailers who probably had their own market stalls and employed family labour for almost all the marketing operations.

So far, transportation cost ranked highest (32.82%) among the costs involved in soyabean marketing. Similar result was obtained by Onu and Iliyasu (2008), who reported transportation cost as the largest (40.4%) component of marketing cost in food grain markets in Adamawa State. Several authors (Gersovitz, 1992 & Omamo, 1998) had long noted the importance of transport costs in sub-Saharan Africa. Similar result was reported by Gabre-Madhin (1991) who confirmed that transport represented the largest share of marketing costs in sub-Saharan Africa. The higher fuel consumption and higher maintenance costs were both the result of the fact that trucks tended to be older and the roads in poor condition in sub-Sahara African.

Another major component of costs identified in this study was storage cost which constituted about 20% of the total costs involved in soyabean marketing. This high percentage for storage costs contradicted the findings of FAO-SUDAN Integrated Food Security Information for Action (SIFSIA, 2011), who found value of storage cost of sorghum as less than 1% of the total marketing cost. Loading and off-loading constituted about 8.72% of the total costs involved in soyabean marketing. SIFSIA (2011) found contrary result as loading and offloading costs for sorghum exceeded the cost of transportation in Sudan.

Another major component of marketing costs were produce/tax and bagging costs. They constituted about 3.83 and 4.09%, respectively, of the total marketing costs. This result is in line with Onu & Iliyasu (2008) who identified produce tax and cost of bagging/rebagging as the second and third most important components of food grains marketing costs in Adamawa State.

Generally, most wholesalers sold soyabean grains directly to retailers, speculators and processors. However, in most Benue State markets surveyed, merchants employed the services of buying agents who were paid sales commission for their service. This accounted for about 8% of their marketing costs. The agents not only helped the merchants to buy soyabean, they also provided market information, temporary storage services and transportation facilities for transferring soyabean.

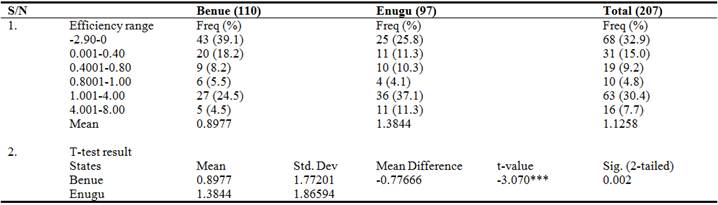

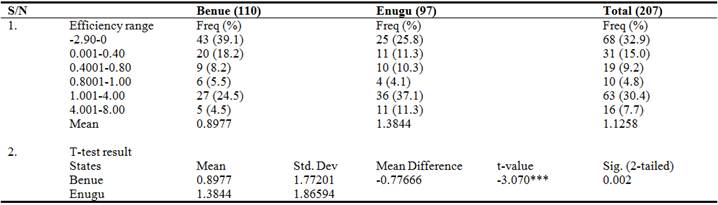

Table 6. Marketing Efficiency of marketers in Benue and Enugu States.

Figures in parentheses are percentages, *** - significant at 1%

Source: Computed from field data, 2014.

3.6. Result of Marketing Efficiency

Table 6 shows the result of coefficient of soyabean marketing efficiency. About 33% of the marketers operated at negative efficiency. This could be as a result of unequal distribution of sales; a situation where few marketers exert influence on the quantity and price. This makes the marginal traders operate at a very low scale that can lead to negative returns. This was due to the characteristics of the market, the structure of soyabean market and the behaviour of market participants which does not depict competitive behaviour. Similar result (negative marketing efficiency) was found by Rangasamy and Dhaka (2008) for flavour milk and milk peda marketed by a co-operative diary in Karnal, Haryana, India.

However, 30.4% of the marketers in the study area operated at efficiency level of between 100% and 400%. This could represent large-scale wholesalers and company agents who exercised control over the market thereby making excess profit. Benue State soyabean marketers had mean efficiency of 90% while their Enugu State counterparts had mean of 138%. From the result, it is evident that Enugu State marketers were generally more efficient than Benue State soyabean marketers. This could be as a result of the presence of many soyabean processing companies and feed mills in Enugu State which the traders supply to. In the course of the study, it was found that the major soyabean demanding firm in Benue State were only the defunct Taraku Mills (now Growrich Mills), Hule & Sons (located in Wannune) and very few feed mills. Whereas in Enugu State, there were so many of these firms. Among them included Phinomar in Ngwo, Farm Associates, Jacon; both in Holy Ghost Enugu, Mamex mills, Hillson & Sons, Emmco, Ave Investment (Choice feed mill), Alpha farm (Emene), Monns, Superior feedmill, Goldmedal feed mill, Kingsize feed mill, Tropical feed mill in Nsukka, Nebo farm and so on.

The mean marketing efficiency of about 90% found for Benue State soyabean marketers was similar to the findings of Akanni (2010) who found mean efficiency of 82% for maize marketers in South Western Nigeria. But, this result contradicted the high efficiency ratio of 254.7 percent for food grain marketers in Adamawa State found by Onu & Iliyasu (2008). However, the result of the t-test (Table 4) showed that efficiency of soyabean marketers in Benue State was significantly different (t=-3.070; P ≤ 0.01) from Enugu State soyabean traders. This implied that the difference in marketing efficiency between Benue and Enugu State marketers was significantly different from zero, hence, Enugu State soyabean traders had significantly higher marketing efficiency than Benue State soyabean marketers. This could be as a result of their additional marketing costs which translated to higher value addition in the marketing process.

4. Conclusion and Recommendations

This study came up with some empirical findings about soyabeans marketing in Benue and Enugu States with a view to enhancing the social and economic developments in the area and in Nigeria at large. Results showed that the moderately high marketing and net margins obtained especially among retailers could explain their low participation of other food stuff marketers in soyabean marketing. Their marketing costs were dominated by transportation and handling costs and there was a significant difference in the marketing costs among retailers in the two States. Although, the mean efficiency of 113 and 90% were found, many of the traders were negatively efficient in soyabean marketing. However, Enugu marketers were significantly more efficient than their Benue counterparts.

There is the need to organise traders at the community level to be able to collect a minimum quantity of grains at identified collection points such that evacuation to factories can be done in a cost-effective manner. Marketing efficiency would improve if there is increased household utilization of soyabean. This will not only ensure increased output but massive participation of many traders which will invariably bring down the margin to the barest minimum. There should be improvement in the transportation sector in form of construction and rehabilitation of roads and railways and other infrastructural facilities. Unnecessary road blocks and multiple taxation at these road blocks and markets should be checkmated. Moreso, efficiency in soyabeans marketing would be improved if information is made available to marketers through the establishment of Market Information System (MIS). Government should set up MIS in order to improve the availability and accessibility of market information. Better market information services would enable market agents to read price signals more accurately and promptly, and therefore to make more reliable price forecasts that would aid them in making correct marketing decisions.

References

- Achike, A. I. & Anzaku T. A. K. (2010). Economic Analysis of the Marketing Margin of Benniseed in Nasarawa State, Nigeria.Agro-Science Journal of TropicalAgriculture,Food,Environment and Extension,9 (1) January 47–55.

- Achoga, F. O. & Nwagbo, E. C. (2004). Economic assessment of the performance of private sector marketing of fertilizer in Delta State, Nigeria. Paper presented at the annual conference of Nigeria Association of Agricultural Economists on "Agricultural marketing and commercialization for sustainable development" at Ahmadu Bello University, Samaru – Zaria.

- Adekanye, T. O. (1982). Marketing Margins for Food: Some Methodological Issues and Empirical Findings for Nigeria. Canadian Journal of AgriculturalEconomics, 30 (2): 333-344.

- Adekanye, T. O. (1988). Spatial price analysis for rice in Western State of Nigeria, In: T. Adenkanye, (Ed.), Readings in Agricultural Marketing. Ibadan, Longman Nigeria Limited: 129-150.

- Adekunle, O. A., OgunLade, I. & Oladele, O. I. (2003). Adoption of soybeans production technology in Kwara State, Nigeria. Journal of Extension System, 19 (2): 32-3.

- Akanni, K. A. (2011). Economics of Marketing of Food Grains in South Western Nigeria. Economia Mexicana NUEVA ÉPOCA DE próxima publicación/Forthcoming.

- Amobi, I. D. (1996). The Marketing of staple food crops in Enugu State, Nigeria: A Case study of rice, maize and beans.M.Sc. Thesis, University of Nigeria,Nsukka.

- Arene, C. J. (2003). Introduction to Agricultural Marketing Analysis and Policy, Nsukka: Fulladu Publishing Company.

- Babatunde, R. & Oyatoye, E. (2000). Food Security and Marketing Problems in Nigeria: The Case of Maize Marketing in Kwara State. http://www.Tropentag.de/2005/abstractslinks/Babatunde DEV4Uzi.pdf. Assessed on 09/03/11.

- Barallat, J. E., McLaughlin, W. & Lee, D. R. (1987). Alternative methods for modelling potato marketing margin behaviour in Spain: Private and public implications. ISHSActaHorticulturae203: IX Symposium on HorticulturalEconomics, XXII IHC, Box 500, 3001 Leuven, Belgium.

- Benue Agricultural and Rural Development Authority [BNARDA, (1998)]. Crop Area and YieldSurvey, Report by Benue Agricultural and Rural Development Authority (BNARDA): 35.

- Ebe, F. E. (2007). Economic Study of Feulwood Marketing and Consumption in Enugu State, Nigeria, Ph.D Thesis University of Nigeria, Nsukka.

- ENADEP (2009). Enugu State Agricultural Development Programme: Annual Report; 36.

- ENADEP (2012). Enugu State Agricultural Development Programme: Annual Report; 27.

- Enete, A. A. (2003). Resource Use, Marketing and Diversification Decision in Cassava Producing Households of sub-Saharan Africa. Ph.D thesis, dissertation, K. U. Leuven, Belgium.

- Enete, A. A. & Agbugba, I. K. (2008). Charcoal marketing in Abia State In: Umeh, J. C., C. P. O. Obinne & W. Lawal (2008). Prospects and Challanges of adding value to Agricultural products. Proceedings of the 22nd Annual National conference of FAMAN held at University of Agriculture Makurdi, 8th-11th Sept, 2008: 338-346.

- Fafchamps, M. & Madhin-Gabre, E. Z. (2001). Agricultural Markets in Benin and Malawi: Operation and performance of traders. IFFU Report on the impact of agricultural Market Reform on small-Holder Framers in Benin and Malawi.

- Fafchamps, M. & Minten, B. (2001). Social capital and agricultural trade. Am. J. Agric.Econ., 83: 680-685.

- FAO, (2011). Mapping supply and demand for animal-source foods to 2030. Animal Production and Health Working Paper 2, FAO, Rome, Italy.http://www.fao.org/ag/againfo/resources/documents/latest_pubs/al747e00.pdf

- Gabre-Madhin, E. Z. (1991). Transfer Costs of Cereals Marketing in Mali Implications For Mali's Regional Trade in West Africa. An M.Sc Thesis Submitted to the Department of Agricultural Economics, Michigan State University.

- Gabre-Madhin, E. Z. (2001). MarketInstitutions, Transaction Costs andSocial Capital inthe Ethiopian GrainMarket.Research Report 124 –International Food Policy Research Institute (IFPRI), Washington: 26–34.

- Gabre-Madhin, E. Z. (2002). The role of Intermediaries in enhancing market efficiency in the Ethiopian Grain Market. Journal of Developing Economics 25:202 Elsevier Science Publishers.

- Gersovitz, M. (1992). Transportation, State Marketing and the Taxation of the Agricultural Hinterland. Journal of Political Economy, 97: 1113-1137.

- Jayne, T. S. (1994). Do High Food Marketing Costs Constrain Cash Crop Production? Evidence from Zimbabwe, Reprinted for private circulation from Economic Development and Cultural Change. January 1994, 42 (2): The University of Chicago.

- Khols, R. L. & Uhls, J. N. (1967). Marketing of Agricultural products, Macmillan Publishing Company, New York, 594.

- Mejeha, R. O., Nwosu, A. C. & Efenkwe, G. E. (2000). Analysis of rice marketing in Umuahia Zone: Policy implications for Food security in Umuahia Urban, Abia State. In: Busary, LD, A. C. Wada, E. D. Emolehin, A. A. Idowu and G. N Asumugha (eds).AgriculturalProductionand Strategies for meetingNigeria’s Food Demand in theNextMillennium.Proceedings of the 33rd annual conference of the Agricultural Society of Nigeria held at National Cereals Research Institute, Baddegi, Niger State. 45-51.

- Minot, N. & Goletti, F. (2001). Rice MarketLiberalization and Poverty in VietNam. International Food Policy Research Institute, Washington, D.C. Research Report 114.

- Myaka, F. A., Kirenga, G., & Malema, B. (Eds). (2005). Proceedings of the First National Soyabeans Stakeholders Workshop, 10th-11th November 2005, Morogoro Tanzania.

- Negassa, A. (1994). Vertical and Spatial integration of grain markets in Ethopia: Implications for food security policies. Working paper 9, Grain market research project, Ministry of Economic Development and cooperation, Ethopia, Addis Ababa: 1-53.

- NPC (2006). National Population Commission. National Population Census, Federal Republic of Nigeria official gazette, 94 (4) Lagos, Nigeria.

- Okereke, O. (1988). Price Communication and market Integration: A case study for grains in Anambra and Imo states of East Nigeria In Readings in Agricultural Marketing by T. O. Adekanye (ed). Longman Nigeria limited: 148-156.

- Okuneye, P. A. (2002): FAO Production Year Book (45), Rome.

- Okunmadewa, F. Y. (1990). An analysis of alternative marketing arrangements for food grains in Oyo State, Nigeria. Unpublished Ph.D Thesis Submited to Department of Agricultural Economics, University of Ibadan, Nigeria

- Oladapo, M. O., Momoh, S., Yusuf, S. & Awoyinka, Y. (2007). Marketing margin and spatial pricing efficiency of pineapple in Nigeria. Asian J. Market., 1: 14-22.

- Olukosi, J. O. & Isitor, S. N. (1990). An Introduction to Agricultural Marketing and Prices, Principles and Application, Agitab Publishers, Zaria: 34.

- Olukosi, J. O., Isitor, S. U. & Ode, M. O. (2005). Introduction to Agricultural Marketing and prices: Principles and Applications. 2nd Edition, Living Books Series, GU publication, Abuja, Nigeria: 116.

- Omamo, S. W. (1998). Transport Costs and Smallholder Cropping Choices: An Application to Siaya District, Kenya. American Journal of Agricultural Economics, 80: 116-123.

- Onu, J. I. (2000). An Analysis of the Structure and Performance of the Cotton Market in Northern Nigeria. Unpublished Ph.D. Thesis, Department of Agricultural Economics, University of Ibadan, Nigeria

- Onu, J. I. & Iliyasu, H. A. (2008).An Economic Analysis of the Food Grain Market in Adamawa State, Nigeria,World Journal of Agricultural Sciences4 (5): 617-622.

- Rangasamy, N. & Dhaka, J. P. (2008). Marketing Efficiency of Diary Products for Co- operative and Private Diary Plants in Tamil Nadu- A Comparative Analysis. Agricultural Economics Research Review, 21: 235-242.

- Riley, H. (1972). Improving Internal Marketing Systems as Part of National Development Systems. Occassional paper no.3, Michigan State University, Latin American Studies Center, East Lansing.

- SIFSIA, FAO-Sudan Integrated Food security Information for Action (2011). Marketing Costs and Margins. Price and Market-Structure Analysis for Some Selected Agricultural Commodities in Sudan. Food Security Technical Secretariate/Ministry of Agriculture (FSTS).

- Singh, S. R., Rachie, K. O. & Dashiell, K. E. (1987). Soybean for the Tropics: Research, Production and Utilization. IITA Research, Chieshester: a Wiley Inter-science Publication, John Wiley and Sons Ltd: 81–87.

- Tomek, W. G. and Robinson, K. L. (1990). Agricultural Product Prices. Cornell University Press, Ithaca, New York, USA.

- World Bank, (2009). Doing Business website. Accessed at doingbusiness.org. The World Bank, Washington, DC.

(D. P. Ani)

(D. P. Ani)  (D. P. Ani)

(D. P. Ani)  (S. A. N. Chidebelu)

(S. A. N. Chidebelu)  (A. A. Enete)

(A. A. Enete)