Factors Influencing the Use of Mobile-Phone Based Financial Services in Tanzania

N. Viswanadham

Department of Accounting and Finance, School of Business, the University of Dodoma, Dodoma, Tanzania

Email address

Citation

N. Viswanadham. Factors Influencing the Use of Mobile-Phone Based Financial Services in Tanzania. International Journal of Management Science. Vol. 3, No. 2, 2016, pp. 12-16.

Abstract

This study assumes to identify various factors inducing the use of operative use of Mobile-phone based Financial Facilities (mobile money) Dodoma Urban is used as a study. The study used both qualitative and quantitative methods done review and semi intended interviews. A modest arbitrary trial plan was used to select defend ants since the customers and purposive sample was used to choice defend ants from workers. The study enclosed 60 respondents of which, their retorts were examined using a computer package of SPSS. The study discovers that the maximum extensively used service is M-pesa. It was exposed that subscribers use these mobile hand set commercial services not only for sending currency to domestic or networks but also for casher serves. Also mobile telephone based economic facilities providers should inferior the deal costs to move more customers to join.

Keywords

Financial Services, M Banking, Technology Based Services

1. Introduction

The organization and the increasing capacity of trade now a day’s state computerized infrastructures as a proper and inoffensive way as they take advantage of mobile phone institutions that have attained to bring profitable amenities to millions of un-banked consumers.

Mobile commerce (M-commerce) means all actions of boundary amid a customer and a mobile device (Alex 2010). These may also include but not limited to the issuance of electric vouchers and shopping over the internet over a mobile device.

Palvia (2009) stated that in 2004, Finland-based Nordea bank knowledgeable an extraordinary growth of 30% from the process of transaction-based mobile economic facilities. Mobile banking as the term connotes is banking "on the move" with the aid of a mobile wireman’s which can be used for diverse resolutions at anytime and anywhere. From various literatures reviewed, 30% of households in the United Kingdom use their mobile phones to perform banking processes (Quick 2009). Research also shows that the internet has only a penetration rate of 16% in a population of 140 million in Nigeria, whereas mobile technology is close to 50% penetration with prospects for growth (Alex 2010). Mobile devices show promise for the future, and the ability to reach larger customer population irrespective of their location, which in turn, can lead to customer loyalty. Laukkanen (2007) stressed that mobile banking allows banking customers to conduct their financial services such as alerts, i.e. receipt of short-message-services (SMS) when there is a movement in their accounts. It also allows customers to carry out other financial services such as balance enquiries, interest rate enquiries, payment of bills, internet shopping, transfer to other accounts and password change.

According to BOT reports of December 2014, a total number of registered mobile phone subscribers have increased to 31.8 million and there were more than 11 million active mobile money accounts and approximately 153,369 agents in Tanzania across four deployments (Mpesa, Tigopesa, AirtelMoney and Easy Pesa). In the same month, mobile money deployments performed transactions worth more than TZS 3 trillion (US$1.8 billion).

The finding of the study will enable the government to be familiar with many issues that touch the fruitfulimplementation of mobile handset based monetaryfacilities. This will allow the strategy makers also to come up with more operativeprocedures that will lead to effectiveacceptance of mobile funding.

2. Review of Literature

Transformative models aim to taking benefit of mobile evolution to offer investment amenities to the economically underserved people. These simulations are typically not founded on a bank version or credit passes; these are the leading communications accepted out by the poor. Mobile currency facilities offer the option of speaking two key obstacles to economic presence for the poor: affordability and physical accessibility. Branchless banking facilities allow MNOs in coordination with banks to offer micro payment communications on mobile phone like deposits, drawings and noble to noble transversals without the need of initial bank branches. It has the conceivable to reduce basically the cost of supply and progress correctness for the consumers with a vast courtesy to new and earlier unbanked segments of the residents.

Inter Media (2013), study done in Tanzania presented that mobile money feasts 45 out of a hundred of the Tanzanian adult population with modifications in demographics.

There is sign in the distribution that using unfair facilities on a mobile convenient can be fairly gloomy, mainly when surfing Internet-like boundaries on mobile strategies (Teo and Pok 2003).

Lennarf and Soderberg (2011) exposed that MSEs were located in town areas and generally in DSM. The MSE were micro but by and great official initiatives with a secure zone having maximum compulsory licenses and credentials required by institutions and the MMT operators were mostly productive MSEs that do not indicate the usual Tanzanians in MMT training.

Orotin et al (2013) did a study on effects allowing admittance to mobile telephone cash in Uganda. He uncovered that a wide connection of executives was the extreme significant part for admission to mobile phone exchange services. The maximum used mobile hands exchange facility was broadcast of currency to families and systems.

Kamotho (2008) on Mobile handset lending practice participations in Kenya intended out that mobile phone banking is typically used for currency project due to the negligible costs of roll-out and the economies of supervision low-value communications unstated by leveraging schemes of outstanding third-party agents.

Kodjo and Raymond (2013) establish that the overall perception that there is no straight association between mobile phone protection and mobile currency protector could be accredited to the fact that users trust the service benefactor has put in place acceptable events to defend the mobile money facility. As one of the main causes of customer ambitious deception is PIN allotment, it can be seen from this exploration that this is not a very mutual repetition. However, the 9% that collective their PINs did so with their relatives and occasionally with client agents to help them in managing one facility or the other from their mobile currency.

Oketch (2013) augments that construction a supervisory outline for mobile currency and financial enclosure among MNOs in Uganda would expand economic firmness and integrity. This would further protect customers, particularly those for whom this is the only network to access prescribed monetary services. The guidelines would also protection the economic system in contradiction of the hazards of a relaxed cash-based frugality. Though mobile headphones were once observed as a amenity item, their current growth and international diffusion has been amazing.

Banks can take full benefit of this new stand for accurate mobile submissions which have been made obtainable (Eckhardt, et al 2009). With mobile banking, low-income individuals no lengthier necessity to use unusual time and economic possessions to portable to distant bank branches and since mobile banking dealings cost far less to procedure than communications at an automatic teller machine (ATM) or branch, banks can brand a profit treatment even minor money assignments and incidentals (BAI 2004 and Booz Allen 2003).

Reviews from GSMA said that, on a comparative source, the defenselessness of current payment gadgets to currency laundering and funding of extremism, such as cash, are superior in all compliments except for the speed of dealings.

However, for the nation like Tanzania, the specialists agree that the possible is huge, the fact that not more than 20 per cent of the persons have bank books while the mobile marketplace is predictable to break the 50 per cent diffusion barrier mostly due to influx of the grit cables in 2012 to 2015 (The Citizen, 2011).

3. Methodology

Orodho (2003) describes research plan as the arrangement, summary or plan that is used to producereplies to research difficulties. In this study, a situation study method was assumed in examining the Factors influencing the use of mobile phone based financial services.

In this study, the researcher employed probability sample since it gives chance for each unit of population to be selected as every individual has an equal chance of being comprised in the study.

Following Kothari (2004) the formula below was used:

Where;

n = sample size.

z = standard variant at a given confidence level.

σ = standard deviation of the population.

e = acceptable error (the precision).

Therefore the study used sample size of 50 respondents

The study represented statistics from both primary and secondary sources for the spirit of validation the rationality and dependability of the documents. The approaches employed by the researcher throughout data collection comprised observation, interview, and written review.

Data collected was amended to notice mistakes and oversight then coded so as make it modest prior to analysis. Measurable data was confirmed, and then examined by using Statistical Package for Social Science (SPSS) version 16. The descriptive statistics was used to analyze the data, frequency distribution of answers showing factors influencing the usage of mobile phone based financial services.

4. Data Analysis

Major categories of Mobile phone based financial services registered

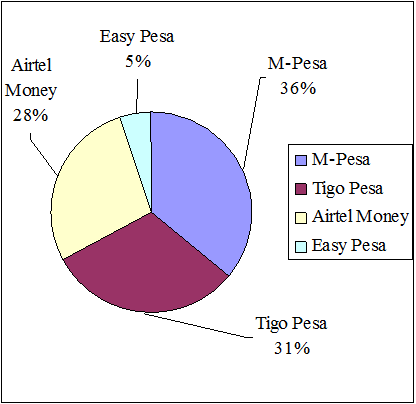

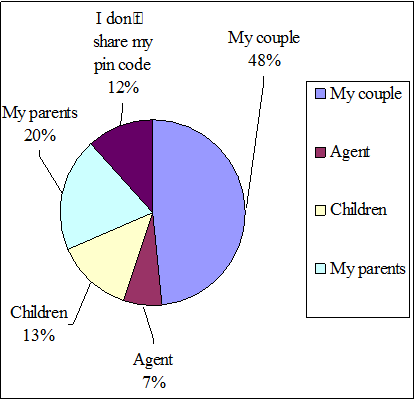

The study establish out the major categories of mobile telephone based financial facilities. The study exposed the subsequent facilities (percentage of users in brackets) M-pesa from Vodacom (36%), TigoPesa from Tigo (T) Ltd (31%), Airtel Money offered by Airtel (T) Ltd (28%) andEzy Pesa from Zantel (5%). According to the findings, M-pesa from Vodacom is the most used mobile phone-based financial service. This is illustrated in figure 1.

Source: Field Data, (2015)

Figure 1. Major types of Mobile phone based financial services registered.

4.1. Major Facilities That Mobile Handset Based Financial Providers Offer

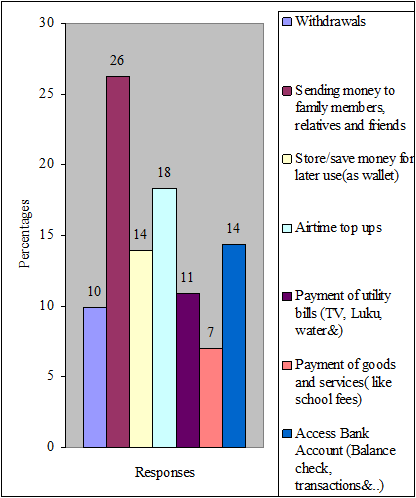

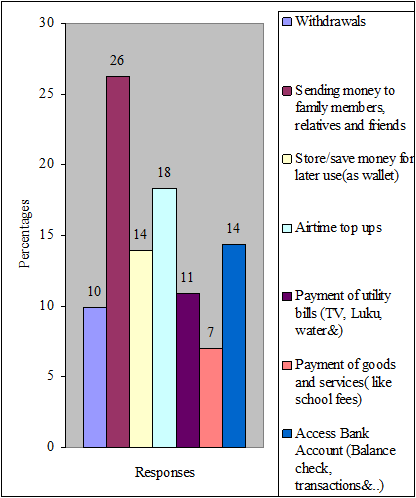

The findings and the results on the major facilities accessible by mobile phone based financial facilities, specify the following: the numerous response exposed that 26% use the facilities for sending currency to their families and networks, 18% for air time top-ups, 14% bank account access and savings, 11% used for payment of efficacy bills, whereby 10% for draws and 7% for payment of goods and services. This is illustrated in figure 2.

Source: Field Data, (2015)

Figure 2. Major services offered by Mobile phone based financial providers.

4.2. Factors Influencing Mobile-Phone Based Financial ServicesIdentification Cards Commonly Used for Registration

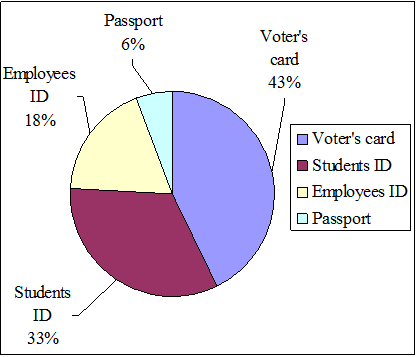

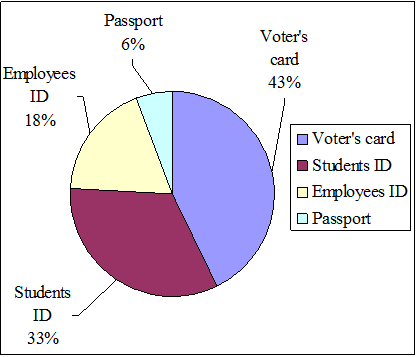

The findings of the study specify the following types of identification cards. Voter’s card (43%), student’s ID (33%), employees IDs (18%) and few passport (6%). Figure 3 illustrates the results of the findings.

Source: Field Data, (2015)

Figure 3. Identification cards commonly used for registration.

4.3. Effective Use of ID Card When Creation Withdrawals from the Representative

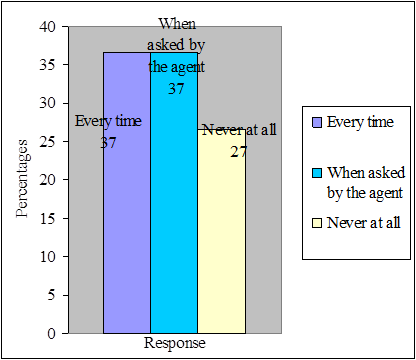

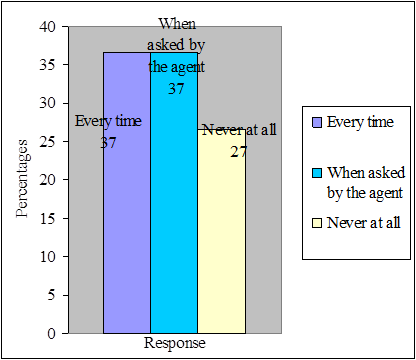

The study wanted to know how often subscribers use their IDs when making withdrawals. The results show that, 37% use IDs every time as well as when asked by the agent in which 27% of respondents said that they perform withdrawals without showing their IDs. The finding indicates that there is violation of rules which insists that in every transaction from the agent, the subscriber should show his /her ID.

Source: Field Data, (2015)

Figure 4. Effective use of ID card when making withdrawals.

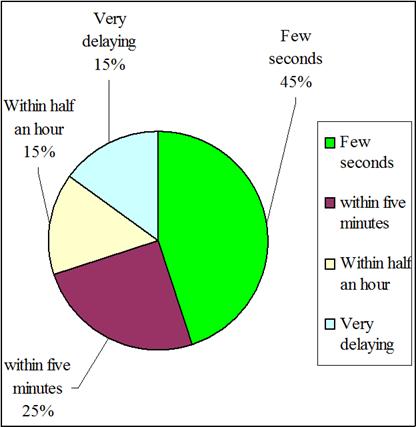

4.4. Real use of Pin Codes

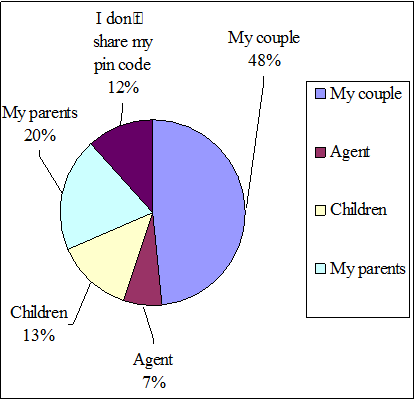

Here the respondents were asked to respond on the real use of their pin codes. The out comes as per Figure 5 shows that 48% of the study respondents said that they do share their pin codes with their connects, 20% with their parents, 13% with their children especially old fellows 12% said they do not share their pin codes and the rest 7% said they share with agents. The results indicate that subscribers’ money is at risk because most of them do not maintain privacy.

Source: Field Data, (2015)

Figure 5. Real use of pin codes.

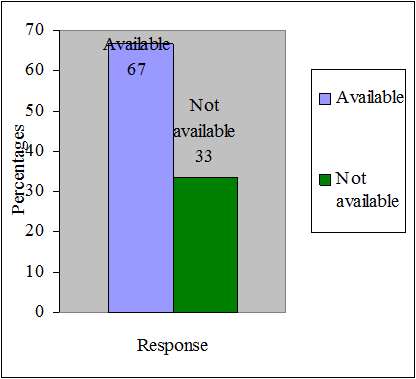

4.5. Accessibility of Near Managers/Agents

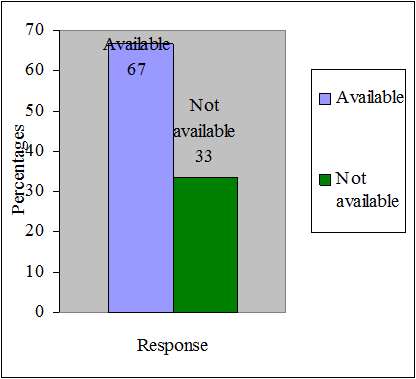

The researcher required to know if managers are found close subscribers. The results show that 67% said that agents are available at nearby subscriber’s residence whereby 33% only said that agents are found far from their residence. This indicates that mobile phone financial services are easily obtained by their subscribers. Figure 6 illustrates the results.

Source: Field Data, (2015)

Figure 6. Obtainability of near agents.

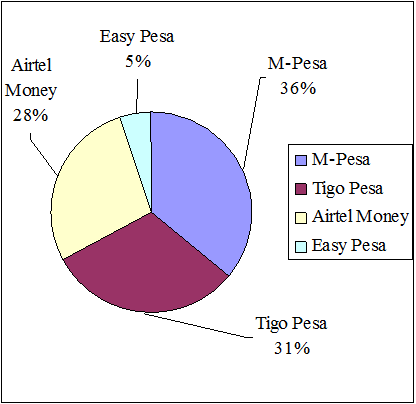

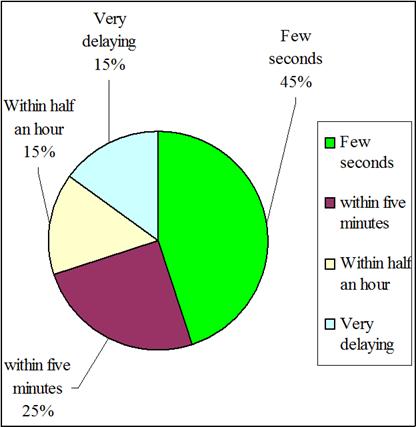

4.6. Length for Creation Financial Transaction

Figure 7 shows the result of the answers on the length taken to make financial transaction using M-banking. It was about 45% said that it takes few seconds only to complete transaction, 25% said it take about 5 minutes, 15% indicated within an hour and 15% indicated it delays. This indicates that it takes no time to make transaction unless otherwise there is network failure.

Source: Field Study, (2015)

Figure 7. The Duration for making financial transaction.

5. Conclusion

Though Mobile-phone based financial amenities appear to cut across all clusters, usage is more noticeable among stealer age collections. Income estimation is separated as belongs to the thresholds that generate access into Mobile-phone based monetary services. Some operators with no detailed income bases were recognized as steady users suggesting a huge possibility that they rely on revenue of others. This indicates that Mobile-phone based financial services have created a difficult path for income rearrangement.

Mobile banking is the evolutionary step for banking services in Tanzania. It is a supplementary facility built upon current financial clarifications which have all complete financial services easy and at focused cost both to clients and fiscal service providers. It has also condensed the faith on bank branch substructures and even admission to the internet done the processers. Most clients view phone banking as actuality very endangered and are satisfied with its custom. It is therefore, predictable that with the right structures and acceptable financial laws propagated to protection customers phone banking will in the adjacent upcoming be the most favored and suitable expedient for leading banking dealings in Tanzania and most developing countries of the world.

References

- Abdalla H. K and Semkwaji D. (2011). "The Role of Mobile phone on Sustainable Livelihood", Economic and Social Research Foundation (ESRF), Discussion paper No. 33. Ursion state Dares salaam.

- Akpan, I. (2009). Cross channel integration and optimization in Nigerian banks. Telnet Press Release, 20(1): 1-4.

- Alex, K. (2010) Is it finally time for M-Commerce [online], Available at: http://ovum.com/wp-content/uploads/2011/10/ST_IT_Q2_2010.pdf (Accessed: Nov 5, 2014).

- Ame, A. M. (2011) Research Methods, Course Materials. University of Dodoma.

- Ba, S. and Pavlou, P. A. (2002). "Evidence of the effect of trust building technology in electronic markets: price premiums and buyer behavior". MIS Quarterly, vol. 26, no. 3, pp. 243-268.

- Eckhardt, A., Laumer, S. and Weitzel, T. (2009). Who influences whom? Analyzing workplace referents‟ social influence on IT adoption and non-adoption. Journal of Information Technology 24 (1), pp. 11-24.

- InterMedia (2013), "Mobile Money in Tanzania; Use, barriers and opportunities" Tanzania.

- InterMedia (2013), Mobile Money, A Path to Financial Inclusion; Tanzania.

- ITU (2008a), Worldwide mobile cellular subscribers to reach 4 billion mark late 2008, ITU [online], Available at: http://www.itu.int/newsroom/press_releases/2008/29.html (Accessed: January 15, 2014).

- ITU (2008b), Africa marks unprecedented growth in mobile sector, ITU [online], Available at: http://www.itu.int/newsroom/press_releases/2008/10.html (Accessed: January 15, 2014).

- ITU (2011), The role of ICT in advancing growth in least developed countries – Trends, challenges, and opportunities. Geneva, Switzerland: International Telecommunication Union.

- Kamotho, A. D. (2008) Mobile phone banking: Usage experiences in Kenya.

- Kodjo E. A and Raymond S. M.(2013) Mobile Money Security, Ghana.

- Kombo, D. K. and Tromp, D. L. A. (2006) Proposal and Thesis Writing: An Introduction. Paulines Publications’ Africa, Nairobi.

- Kothari, C.R. (2004). Research Methodology: Methods and Techniques. 2nd Edition, New Age International, New-Delhi, India.

- Laukkanen, T. (2007) ‟Internet versus Mobile Banking: Comparing consumer value perceptions". Business Process Management Journal; vol. 13 No. 6, pp. 788-797.

- Leishman P. (2010) Is there Really Any Money in Mobile Money? GSMA. Accessed Nov. 2013 (htt://mmublog.org/global/is-there-really-any-money- in mobile money/9).

- Lennarf Bangens & Bjorn Soderberg (2011) Mobile money transfers and usage among micro- and Small business in Tanzania.

- Ndiwalana, A, Morawezynski, O. & Popov, O (2011) Mobile money use in Uganda: A Preliminary study, Kampala, Makerere University.

- Oketch, M (2013) Uganda mobile money users, Uganda.

- Orodho AJ (2003). Essential of Education and Social Science Research Methods. Mosoal Publisher, Nairobi.

- Orotin P et al, (2013) A Study on Factors Facilitating Access to Mobile Phone Money in Uganda. Greener Journal of Business and Management Studies ISSN: 2276-7827 Vol. 3 (6), pp. 279-291, August 2013.

- Palvia, P. (2009). "The role of trust in e-commerce relational exchange: a unified model", Information & management, vol. 46 No. 4, pp. 213-20.

- Patil, U. V and Keote, M. L (2012) A review on Technologies for E-commerce Access, International Journal of Engineering Science and technology (IJEST), Vol.4 No. 03 Nagpur.

- Porteous, D. (2006). The enabling environment for mobile banking in Africa. London: DFID.

- Quick, C. (2009) "With Smartphone adoption on the rise, opportunity for marketers is calling", nielsenwire. Available at: http://blog.nielsen.com/nielsenwire/online_mobile/with-smatphone-adoption-on-the-rise-opportunity-for-marketers-is-calling/. Accessed Nov, 2014).