| 1. | ||

| 2. | ||

| 3. | ||

| 4. | ||

| 5. | ||

| 6. | ||

Economic Evaluation and Upgraded Implementation of the Project: Shell Pearl Qatar

A. A. Panteloglou, S. P. Vasileiadis, Z. D. Ziaka

School of Natural Sciences and Technology, Hellenic Open University, Patra, Greece

Email address

(A. A. Panteloglou)

(A. A. Panteloglou)  (S. P. Vasileiadis)

(S. P. Vasileiadis)  (Z. D. Ziaka)

(Z. D. Ziaka) Citation

A. A. Panteloglou, S. P. Vasileiadis, Z. D. Ziaka. Economic Evaluation and Upgraded Implementation of the Project: Shell Pearl Qatar. American Journal of Environmental Engineering and Science. Vol. 3, No. 3, 2016, pp. 80-89.

Abstract

Natural gas that is discharged to the environment through flaring or is situated in areas 4000 km away from the final consumers and thus is not economically feasible to transfer through pipelines can be further processed for producing liquid fuels. The process studied in this paper is the Shell Middle Distillate Synthesis, which is applied in the Shell Pearl Qatar project. This project produces liquid fuels – naphtha, kerosene, diesel and baseoil –in approximately 140,000 barrels/day. This paper is a feasibility study of Shell Pearl Qatar project and its sustainability aiming to determine the price range for crude oil over which an investment to a similar project can be profitable. An MS Excel Model was developed in order to perform calculations having as a variable the crude oil price and taking into account all the process and project’s financial data. The results of this model showed that the project remains profitable in crude oil prices above $48.67/barrel. In the price range $55 - $60/barrel, the payout of the project will be in about 9 years. In addition, we proposed a new method for the improvement of the project’s financial results. The use of membrane reactor technology to produce synthesis gas, after appropriate modification, will increase the overall financial performance by about 35%. The study of the new process showed that the project remains profitable in crude oil prices above $30.78/barrel and the payout will be in 4.2 years.

Keywords

Natural Gas Conversion, Liquid Fuel Production, Membrane Reactor Technology, Economical Assessments, Shell Pearl Qatar Process, Petroleum Engineering

1. Introduction

In recent years there has been great interest in the use of natural gas, on a global scale, both as a source of energy and to produce useful chemicals. This interest becomes larger when one considers environmental benefits compared with the use of crude oil.

It has been found that 5% of global gas supply is rejected through flaring, because it cannot be further processed or sold as such [1]. The amount of gas that in 2014 was rejected to the environment was about 140 billion m3. The World Bank has estimated that the rejection of this quantity of gas through flaring corresponds to the release of 300 million tones of CO2 into the environment. Should this quantity be used to generate electricity it would cover the annual needs of the entire Africa [1].

Correspondingly, the proven gas reserves worldwide have increased by 55% over the last 20 years, as presented in Table 1 [2]. By proven hydrocarbon reserves we mean the estimated quantities of hydrocarbons, which, on analysis of geological and engineering data, can be recovered under existing economic and operating conditions. Estimates of reserves change annually as new exploration discoveries come to light, existing exploration areas are fully valued, existing deposits are mined, and the technological and

operational costs are constantly changing.

Table 1. Proven world gas reserves for the years 1993, 2003 and 2013 [2].

| Year | Natural Gas (in oil equivalent) |

| 1993 | 106.6 bn. ton |

| 2003 | 140.1 bn. ton |

| 2013 | 167.1 bn. ton |

The main commercial use of natural gas is burning, either for electricity or heat production, from residential or industrial consumers or for moving vehicles [31-38]. Before its consumption the gas should be transferred from the pumping space. It has been found that the transport of gas by pipeline remains economically feasible when the total distance of the pipeline does not exceed 4000 km [3]. Proven natural gas reserves could be more if those found at a distance more than 4,000 kilometers, have undergone process to other useful products.

In conclusion, both for environmental and economic reasons, natural gas can be used to produce other chemicals, when it is distant from the final consumer or discarded into the environment through flaring.

2. Scientific Background

Natural gas can now be compared to crude oil, as it is one of the most important raw materials for the production of other chemicals. "Cleaning" raw natural gas produces water, hydrogen sulfide, carbon dioxide, mercury, and other hydrocarbons such as ethane, propane and butane (LPG). Direct processing may produce many other useful products, such as ethylene, acetylene, propylene and benzene. Processing gas indirectly and after having produced synthesis gas, as shown in Figure 1, the following chemicals can be obtained [4]: hydrogen and ammonia, aldehydes, methanol, hydrocarbons and olefins, formaldehyde, acetic acid, MTBE etc.

Figure 1. Products manufactured by indirect process gas [12].

In this paper we dealt with the production of liquid fuels via the Shell Middle Distillate Synthesis process, SMDS. Royal Dutch Shell plc. invested $19 billion for the construction of the project Shell Pearl in Qatar, for the production of liquid fuels from natural gas utilizing the above process. The project and the process include the following four steps [5] as shown in Figure 2 below:

1. The extraction of natural gas from 22 wells from the marine space of Qatar through two unmanned platforms. Natural gas is transported to land 60 km away, where it is "cleaned". The daily volume of gas processed is 45.31 million cubic meters.

2. Production of synthesis gas by the non-catalytic partial oxidation of methane with pure oxygen in gasifiers (Shell Gasification Process, SGP). The reactions taking place within the gasifiers are:

CH4 + ½O2 ↔ CO + 2H2 (ΔHo = -36 kJ/mol) (1)

CH4 + 1,5O2 ↔ CO + 2H2O (ΔHo = -519 kJ/mol) (2)

CH4 + 2O2 ↔ CO2 + 2H2O (ΔHo = -802 kJ/mol) (3)

CH4 ↔ C + 2H2 (ΔHo = 74,6 kJ/mol) (4)

CO + H2 ↔ C + H2O (ΔHo = -131 kJ/mol) (5)

2CO ↔ C + CO2 (ΔHo = -172 kJ/mol) (6)

The desired chemical reaction (1) of partial oxidation of methane with pure oxygen is slightly exothermic and from the reaction stoichiometry, the ratio of oxygen to methane should be 0.5: 1. In real conditions the ratio of oxygen to methane is 0.7: 1, so that some of the methane is consumed in reactions (2) and (3), which are very exothermic and generate large amounts of heat. The amount of energy produced is consumed in the remaining part of the process and make the entire process self-sufficient. This requires very good temperature and pressure control of the reactor and the reaction conditions are: temperature of 1300° - 1400°C, pressure of 1 - 65 bar and yield of 35 - 40% [7]. Due to the very high temperatures of the reactor the side reactions (4), (5) and (6) may occur, which lead to carbon formation. Finally, the oxygen is produced in air separation units (Air Separation Units. ASU), which are the most energy consuming unit operations.

1. Heavy Paraffin Synthesis, HPS, through the Fischer – Tropsch reactions. The reactor used is a tubular fixed bed reactor and the catalyst carrier is alumina or silica or a mixture of both. The active centers of the catalyst consist ofcobalt molecules and smaller quantities of zirconium, titanium and chromium. The typical Shell composition of the catalyst system is 3-60 parts by weight cobalt with 0.1 to 100 parts by weight zirconium, titanium and/or chromium, per 100 parts by weight alumina/silica carrier. The catalyst is prepared by conventional impregnation methods, or kneading. Finally, the presence of the catalyst in the reactor is in the form of fixed bed, the catalyst bed has an external surface 5 – 70 cm2/ml and an internal surface of 100 – 400 m2/ml. The catalyst activation requires contact with hydrogen or a gaseous stream containing hydrogen at a temperature of 200° - 350°C [8]. Finally, the reactor operating conditions are: temperature of 175° - 275°C and pressure of 10 - 75 bar.

The reactions that take place in this reactor are:

Methane:

3H2 + CO → CH4 + H2O (7)

2H2 + 2CO → CH4 + CO2 (8)

4H2 + CO2 → CH4 + 2H2O (9)

Paraffin:

(2n+1)H2 + nCO → CnH2n+2 + nH2O (10)

(n+1)H2 + 2nCO → CnH2n+2 + nCO2 (11)

(3n+1)H2 + nCO2 → CnH2n+2 + 2nH2O (12)

Olefin:

2nH2 + nCO → CnH2n + nH2O (13)

nH2 + 2nCO → CnH2n + nCO2 (14)

3nH2 + nCO2 → CnH2n + 2nH2O (15)

Alcohols:

2nH2 + nCO → CnH2n+1OH + (n-1)H2O (16)

3nH2 + nCO2 → CnH2n+1OH + (2n-1)H2O (17)

The reactions that are thermodynamically favored are reaction (11) for the production of paraffin and reaction (14) for the reaction of olefin [13].

The industry of Shell in Qatar includes 12 heavy paraffin reactors, each of them comprising 200 tones catalyst and each weighing a total of 1200 tones.

2. Heavy Paraffin Conversion, HPC, to finished products in a diffusion reactor (trickle bed reactor) in the presence of a catalyst. The catalyst comprises one or more noble metals of group VIII of the periodic table of elements. Specifically, the catalyst system used in the SMDS process consists of 0.2 to 1% by weight platinum or palladium on alumina – silica carrier. The reactor operating conditions are: temperature of 250° - 350°C and 10 - 75 bar pressure. The product of this reactor is subjected to fractionation in a traditional distillation column. The lightweight products of distillation are recycled to the HPC reactor.

Figure 2. Simplified process flow diagram SMDS [6].

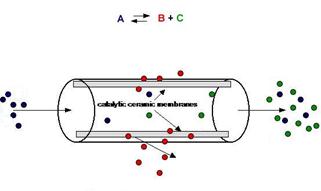

Due to the low quantity of syngas production, we recommend using a different reactor technology, which will increase the total efficiency of the process. Such as potential technologies to contribute can be membrane reactor technology or pressure swing adsorption technology. We present and analyze here the use of membrane technology, which can be applied after appropriate modificationsto the conventional processes. The membrane reactors in chemical engineering concept integrate reaction and separation processes in a single process. This technology is utilized in reactions limited by thermodynamic and kinetic phenomena, to increase conversion efficiency or selectivity of the overall reaction. The operation of such a reactor is either to eliminate the production of a byproduct or to transfer a byproduct out of the reaction or to remove the main product from the reactor, as shown in Figure 3. All these lead to a lower temperature reaction and reduced deactivation of the catalyst, thus longer catalyst life and higher energy savings.

The membrane reactor is a device in which, simultaneously, taking place chemical reaction and separation, due to membrane, as shown in Figure 3.

Figure 3. Diagram function of the membrane [15].

The types of membrane reactors that are widely used in industry, depending on the function and location of the membrane, are shown in Figure 4. In general, these reactors may be categorized as follows:

• Fixed Bed Permreactor, FBP: In this type of reactor the catalyst particles are arranged in a fixed bed in a tubular reactor. Around the catalyst is the membrane, usually made of ceramic material to withstand the high pressures of this type of reactor. The membrane is non catalytic, thus does not play the role of catalyst.

• Catalytic Permreactor, CP: There is no catalyst in the tubular reactor, but the film itself plays the role of the catalyst, as it has been impregnated with the catalyst liquid.

• Catalytic Fixed Bed Permreactor, CFBP: This reactor is a combination of the two described above, as the catalyst particles located in a fixed bed in a tubular reactor enclosed by the membrane, which has also been impregnated with catalytic material [16].

The process that we propose includes methane steam reforming to produce synthesis gas and carbon dioxide. The reactions that take place are shown below. The reactor used is the Fixed Bed Permreactor. The membrane reactor is sol - gel hollow cylindrical reactor made of aluminum. The film consists of three microporous levels, which are made by using sol – gel technique, the first made of gamma-alumina and the other two of alpha-alumina. The catalyst is a 15% by weight nickel supported on calcium aluminate. The catalyst is in the form of particles of diameter 0.92 mm [16]. With this method, the reactor performance is expected to increase to 65 - 70%, which will lead to increased production of the desired products.

CH4 + H2O(g) ↔ CO + 3H2 (ΔHo = 206 kJ/mol) (18)

CO + H2O(g) ↔ CO2 + H2 (ΔHo = -41 kJ/mol) (19)

CH4 ↔ C + 2H2 (ΔHo = 74,6 kJ/mol) (4)

CO + H2 ↔ C + H2O (ΔHo = -131 kJ/mol) (5)

2CO ↔ C + CO2 (ΔHo = -172 kJ/mol) (6)

The selection of the membrane materials is based upon the selectivity of the appropriate products in order to achieve the desired conversion of the process.

Figure 4. Classification of membrane reactors in accordance with the function and location of the film [12].

3. Feasibility Study

A feasibility study incorporates financial terms that need to be explained as follows [9]:

• Capital: the commodity expressed in monetary units, which has the capacity to produce other goods.

• Capital Cost: in industry, is the cost of all fixed assets (land, machinery, other services) of an investment. Often referred to as the compensation required by investors or lenders to convince to provide funding to an investment, since investment must return at least the cost of capital, and ideally an amount greater than the cost.

• Annual Operating Costs: the cost of operation covers the whole production process in relation to the nature of the product, and general selling expenses, administration, etc.

• Annual Revenue: income generally equals to the product of the sale price of the product multiplied by the annual production.

• Payout: Payout is the accounting statement of the damage caused to the asset value of the use or over time. The practice of payout consists of removing a specific amount from the gross profits annually until the sum of annual payout is equal to the market value of assets. Usually, the rate of payout is 20%.

• Interest: performance (increase) of capital for a certain period of time.

• Interest Rate: the interest on capital for a monetary unit at a specific time period.

• Inflation: expresses the reduction in the purchasing power of money, i.e. the fact that over time the same amount can buy increasingly fewer goods.

• Discount Rate: is used to calculate the future value of a current amount or the present value of a future amount. In the case of reducing an amount in future value, the discount rate is often called and compound interest rate, whereas in the case of calculating the present value of an amount, the discount rate is referred to as the discount rate.

• Future Value, FV: suppose an amount K, which invested today (time 0) with discount rate e. The value of this amount K after a year is K * e and the amount will increase to K+K*e or K*(1+e). Following the practice of capitalization of interest, the future value of the initial amount K after t years at an annual interest rate e will be:

FVκ = Κ*(1+e)t (20)

• Present Value, PV: if you are going to pay a X amount after t years, then the value of the amount currently (at time 0), called Present Value will be:

PVx = Χ*(1+e)-t (21)

• Cash Flow, CF: the cash flow of the project is defined as the algebraic sum of all the years of life investment. However, since financial flows take place at different times, it is necessary before realized the sum of cash flows to calculate the present value of each cash flow.

• Net present value, NPV: defined as the difference between the present value of annual income less the present value of annual expenses, including initial and subsequent investment in the project. The NPV is given by:

NPV = ![]() (22)

(22)

Where NPV = Net Present Value,

CFτ = Cash Flow for year t,

Ε0 = initial investment in year 0,

ν = the lifetime of the project, and

e = the discount rate.

• Internal Rate of Return on capital IRR: when the discount rate for a particular cash flow increases, the NPV value of cash flows is reduced. The IRR of the EBA capital can be defined as the discount rate that resets the cash flow, i.e. the rate that equates the initial investment value of all future cash flows. The formula that gives the IRR is:

NPV=0 = ![]() (23)

(23)

Where IRR = the internal rate of return for NPV = 0.

When considering a project, regardless of the options, then the terms of acceptance or rejection in relation to the NPV or IRR are as follows:

A. For NPV:

• NPV> 0, The investment is considered advantageous,

• NPV = 0, the financial result of the investment is marginal,

• NPV< 0, the investment is rejected.

B. For IRR:

• IRR>the minimum acceptable discount rate, the investment is considered advantageous,

• IRR = the minimum acceptable discount rate, the investment is considered marginal, applicable when there is no better alternative,

• IRR<the minimum acceptable discount rate, then the investment is rejected.

The financial analysis aims in calculating the cash flows arising from the implementation of the future project. Cash flow is defined by the difference of two ratios: the cash inflow and cash outflow. This difference may be positive or negative. Cash flow refers to a specific period of operation, usually annually. Therefore, for an investment project a list of annual cash flows should be made for the economic lifetime of the investment [9]. The list of cash flows of an investment project is in the following format:

4. Results

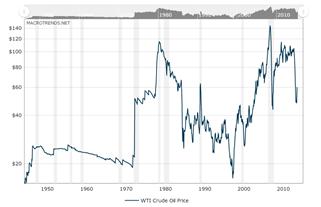

This paper aims to carry out a financial study of the Shell Pearl Qatar project in relation to the price of crude oil. The crude oil prices variation from 1950 to date is presented in Figure 5, where it seems that in the last 15 years the price has not fallen below the $40/boe.

Figure 5. Oil prices (boe), historically from 1950 to date [14].

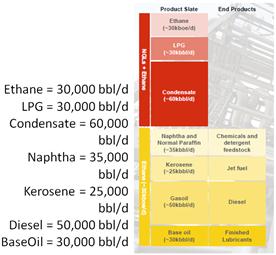

The Shell Pearl Qatar products consist of: methane LPG, condensate, naphtha, kerosene, gasoil and baseoil and the total production amounted to 260,000 barrels/day, as shown schematically in Figure 6. This production, according to the density and energy of each component may be converted to an oil equivalent. Table 3 shows the annual production of Shell Pearl Qatar in oil equivalent.

Figure 6. The Shell Pearl Qatar project’s products.

Table 2. A typical table of cash flows of an investment project [9].

| 0 | 1 | 2 | v | |

| (1) Capital Cost | ||||

| (2) Annual Revenue | ||||

| (3) Annual Operating Cost | ||||

| (4) Gross Profit = (2) – (3) | ||||

| (5) Payout (20%) | ||||

| (6) Interests | ||||

| (7) Taxable Income = (4) – (5) – (6) | ||||

| (8) Taxes = (7) * Tax Rate | ||||

| (9) Net Profit after tax = (7) – (8) | ||||

| (10) Installment Credit | ||||

| (11) Internal Rate of Return = (9) + (5) – (10) – (1) | ||||

Table 3. The annual output of products Shell Pearl Qatar, in oil equivalent.

| Product | Barrels/day (bbl/d) | Oil equivalent barrel/day (boe/d) | Oil equivalent barrel/year (boe/yr) |

| Ethane | 30,000 | 30,000 | 9,855,000 |

| LPG | 30,000 | 21,450 | 7,046,325 |

| Condensate | 60,000 | 56,130 | 18,438,705 |

| Naphtha | 35,000 | 30,835 | 10,129,297.50 |

| Kerosene | 25,000 | 25,425 | 8,352,112.50 |

| GasOil | 50,000 | 48,650 | 15,981,525 |

| BaseOil | 30,000 | 34,500 | 11,333,250 |

| Total: | 260,000 | 246,990 | 81,136,215 |

The completion of the cash flow table in Figure 5 includes:

• The total investment capital. For Shell Pearl Qatar the total investment cost is $19 billions [10].

• The annual operating costs. The operating costs are $2,500,000/day or $821.25 million annually [11].

• The annual revenue. The project revenues depend exclusively on oil prices. The annual production, shown in Table 2 must be multiplied by the price of oil per barrel in order to calculate the annual income of Shell Pearl Qatar. The price of WTI oil on 10/30/2015 was $46.59/barrel. So the annual revenue of the project, if this was the average price of oil throughout the year, is $46.59/bbl x 81,136,215 barrels/year = $3,780,136,256.85/year. Table A1 in Appendices presents the annual project revenues compared with the price of crude oil. It must be emphasized that the working days/year is considered to be 90% of the time or 328.5 days / year. The remaining days of the year maintenance is carried out.

• The payout of the project is 20%.

• We suppose that interest does not exist, since the $ 19 billion cost of capital, is given by the construction consortium of the project, i.e. the State of Qatar and the private company Royal Dutch Shell Plc.

• The State of Qatar tax is 10%.

• Finally, it is assumed that the annual inflation will be 3% and the discount rate is 8%.

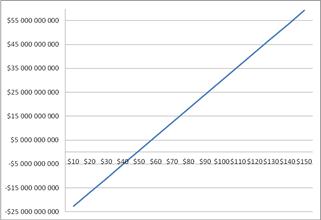

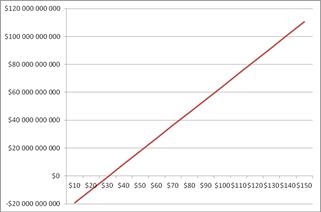

Figure 7. The Net Present Value of the project Shell Pearl Qatar with respect to the price of oil.

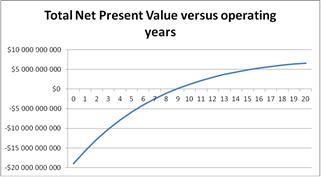

The financial study showed that the Shell Pearl Qatar project is profitable as long as the oil price is above $ 48.75 / bbl, as shown in the graph of Figure 7. With oil prices below this, the project is not profitable. Conversely, oil prices exceeding $100/barrel of oil will gain more than $55 billion, over the project life of 20 years. Finally, payout of the project for crude oil prices between $ 55-60/barrel will be in about 9 years, as shown in Figure 8.

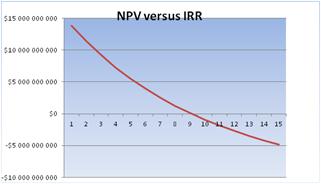

The final analysis to be made has to do with the IRR of the project. For this analysis the oil price of $50.93/barrel was used, which is the 2015 average WTI oil price. According to the theory presented above, the IRR is the discount rate that makes the Net Present Value NPV = 0. Figure 9 shows the graph of the NPV versus IRR. We can see that IRR = 9.1% is than the minimum acceptable discount rate = 8%. Therefore, the investment is considered advantageous.

Figure 8. The Net Present Value over the years of project operation.

Figure 9. NPV versus IRR, when the oil price is $50.93/barrel.

The manufactured products that will result from the membrane reactor are presented in Table 4. From this table we observe an increase in total manufactured products of 50%.

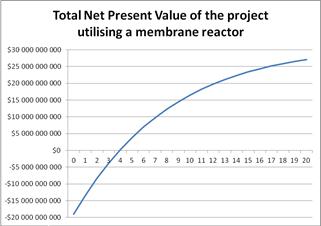

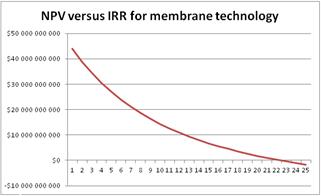

The data shown in Table 4 will be used to carry out the same feasibility study in order to investigate the significant economic effects of the new process. Figure 10 presents the Net Present Value of the new process versus the oil prices and it can be seen that the project remains profitable for oil prices over $ 30.78 / barrel. Payout of the project for crude oil prices between $ 55-60/barrel will be in about 4.2 years, as shown in Figure 11. Finally, Figure 12 shows the graph of the NPV versus IRR for the membrane technology. We can see that IRR = 22.5% is than the minimum acceptable discount rate = 8%. Therefore, the investment is considered advantageous. In Table A2 in Appendices presents the annual expected revenue of the new proposed process with membrane technology with respect to oil prices.

Table 4. The expected results of the proposed production process using membrane reactor.

| Product | Barrels/day (bbl/d) | Oil equivalent barrel/day (boe/d) | Oil equivalent barrel/year (boe/yr) |

| Ethane | 30,000 | 30,000 | 9,855,000 |

| LPG | 30,000 | 21,450 | 7,046,325 |

| Condensate | 60,000 | 56,130 | 18,438,705 |

| Naphtha | 71,220.93 | 62,745.64 | 20,611,942.59 |

| Kerosene | 50,872.09 | 51,736.92 | 16,995,577.76 |

| GasOil | 101,744.19 | 98,997.09 | 32,520,545.06 |

| BaseOil | 61,046.51 | 70,203.49 | 23,061,845.93 |

| Total: | 404,883.72 | 391,263.14 | 128,529,941.30 |

Figure 10. The Net Present Value of the new process with membrane reactor with respect to the price of oil.

Figure 11. The Net Present Value over the lifetime of the project using the membrane reactor.

Figure 12. NPV versus IRR for the membrane technology, when the oil price is $50.93/barrel.

5. Discussion

The first observation to be made has to do with the resulting products of the Shell Pearl Qatar project. The process Shell Middle Distillate Synthesis can be altered so as to yield either light products, i.e. larger amounts of naphtha and kerosene, or larger amounts of heavy products, i.e. diesel and baseoil are more than the others. The Shell Pearl Qatar project, from the commencement in 2011, is set to produce more heavy products. Whenever the need arises can change the settings and produce more light products.

To study the financial viability of Shell Pearl Qatar we created an MS Excel model. The model was constructed so that there is only one variable, the price of crude oil. The purpose of this approach is to determine under what conditions, specifically the crude oil price, is economically feasible to build a similar project, such as Shell Pearl Qatar. It is easily understood that for very low oil prices, investment in the exploitation of remote natural gas resources, similar to Shell Pearl Qatar, will not be viable.

The results of the model showed that the project studied will remain profitable as long as the oil price will be above $48.67/bbl. According to historical oil price data of Figure 5 and because of the great geopolitical tensions in major oil producing countries it is almost certain that oil prices will not fall below $ 50/barrel for long periods of time. Therefore, investments in the exploitation of remote natural gas resources can be made utilizing the Shell Middle Distillate Synthesis process will be viable as long as the oil price will be above $48.67/bbl.

Finally, using the proposed membrane reactor, where the efficiency reaches 70%, the sustainability of the project is maintained and the project remains profitable as long as the oil price is above $ 30.78/bbl.

6. Conclusions

The quantities of gas released into the environment during the extraction of crude oil, by flaring, along with the quantities of natural gas reserves, which are remote from the final consumer and is not economically feasible to exploit, together constitute a vast source of mineral wealth which can be used to produce other useful products. In this paper we studied the Shell Middle Distillate Synthesis process, used in the Shell Pearl Qatar project, as a solution to the above problem. This process includes, after the cleaning of natural gas from coastal area of Qatar, the non-catalytic partial oxidation of methane to synthesis gas and then the Fischer - Tropsch process in order to produce liquid fuels, which include naphtha, kerosene, diesel and baseoil. Financial study of the project was implemented in order to establish under what crude oil prices it remains viable.

Simultaneously, due to the low yield of synthesis gas we proposed a new process that utilizes a membrane reactor, which can yield up to 70%. Financial study of the proposed new process was, similarly, implemented. The Table below presents the analysis of the two processes.

Table 5. Overall comparison of the two processes.

| Shell Pearl Qatar project | New Proposed Process with Membrane Reactor | |

| Mass gas at the inlet (kg/d) | 4,244,003,69 | 4,244,003.69 |

| Efficiency of gasification reactor | 34.40% | 70% |

| Effciency of FT reactor in diesel | 42% | 42% |

| Productsα: | ||

| Ethane (bbl/d) | 30,000 | 30,000 |

| LPG (bbl/d) | 30,000 | 30,000 |

| Condensate (bbl/d) | 60,000 | 60,000 |

| Naphtha (bbl/d) | 35,000 | 71,220.93 |

| Kerosene (bbl/d) | 25,000 | 50,872.09 |

| Diesel (bbl/d) | 50,000 | 101,744.19 |

| BaseOil (bbl/d) | 30,000 | 61,046.51 |

| Products in Total (bbl/d) | 260,000 | 404,883.72 |

| Financial Results: | ||

| Oil Price for profitability ($/bbl) | 48.67 | 30.78 |

| Process profits after 20 years ($) | 6,415,868,178 | 26,830,498,470 |

| Payout (years) | 9.0 | 4.2 |

To conclude, the purpose of this paper is, through studying the Shell Pearl Qatar project, to provide the information for anyone interested to investigate whether there is possibility for return in an investment in a similar process. An in-depth financial study is necessary which will take under consideration the data of the process and social and political factors of the area where the investment will take place.

Acknowledgments

We would like to thank Prof Christos Kordoulis for his scientific discussions and Mrs. Aspasia Davakou for her valuable and in-depth professional contribution and support.

Appendices

Table A1. The ratio of the price of crude oil compared with the expected annual revenue of the project Shell Pearl Qatar.

| Oil price in $ / barrel | Annual expected revenue in $ / year |

| 10 | 811362150 |

| 20 | 1622724300 |

| 30 | 2434086450 |

| 40 | 3245448600 |

| 50 | 4056810750 |

| 60 | 4868172900 |

| 70 | 5679535050 |

| 80 | 6490897200 |

| 90 | 7302259350 |

| 100 | 8113621500 |

| 110 | 8924983650 |

Table A2. The ratio of the price of crude oil compared with the expected annual revenue of the proposed process using membrane reactors.

| Oil price in $ / barrel | Annual expected revenue in $ / year |

| 10 | 1285299413 |

| 20 | 2570598827 |

| 30 | 3855898240 |

| 40 | 5141197653 |

| 50 | 6426497067 |

| 60 | 7711796480 |

| 70 | 8997095894 |

| 80 | 10282395307 |

| 90 | 11567694720 |

| 100 | 12852994134 |

| 110 | 14138293547 |

| 120 | 15423592960 |

| 130 | 16708892374 |

| 140 | 17994191787 |

| 150 | 19279491201 |

References